All players in the air transportation sector are urgently seeking solutions for green aviation as part of a global effort to reduce climate impacts. Driven by societal concern for climate change, increasing and fluctuating fuel prices, and regulatory pressure to cut emissions, the industry, through the International Air Transport Association (IATA), has committed to halving carbon dioxide emissions by 2050. However, the transition to green aviation poses significant challenges.

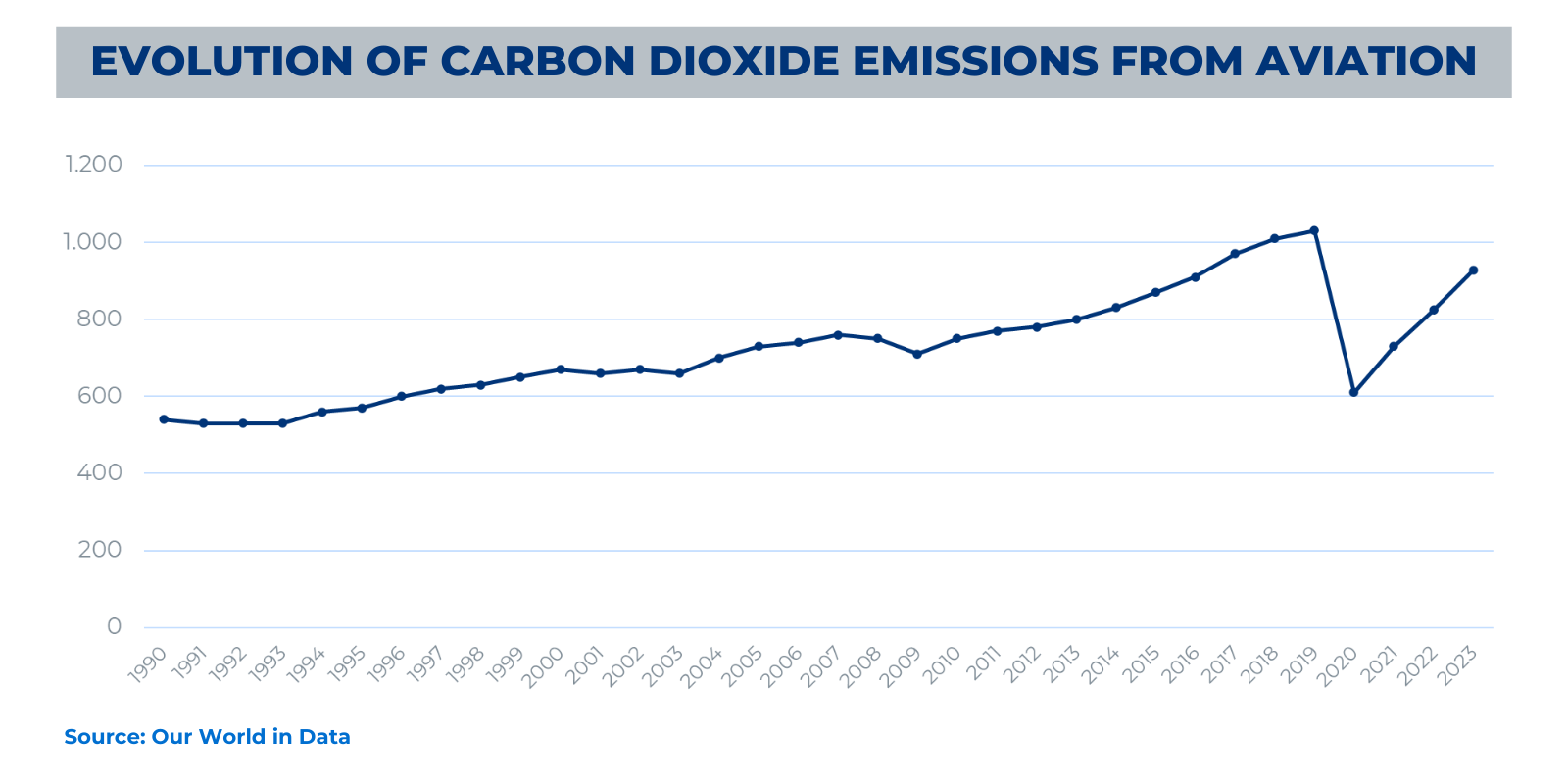

Aviation is notably carbon-intensive, yet its aggregate emissions account for only 2,5% of global emissions and 12% of transport emissions (data for 2019). Although this is relatively low, the sector faces unique hurdles due to its projected growth and the difficulty of transitioning away from fossil fuels. The aviation sector will likely increase its relative impact as other sectors achieve decarbonization more readily. In 2023 total emissions from aviation were slightly below 1,000 MT CO2, comparable to the total emissions from Germany and France that same year. Over 60% of these emissions come from international aviation, the most challenging sector to decarbonize.

Despite the continuous development of new technologies that have significantly increased the efficiency of modern aircraft, such as very high bypass turbofan engines, winglets, and extensive use of carbon composite materials, resulting in up to a 20% reduction in fuel consumption in the latest generation, demand in the commercial aviation sector remains so high that these advancements alone will not be enough to curb emissions.

Before COVID-19, demand was growing at about 4% per year, and similar levels have already been reached. At this rate, total demand will double in less than twenty years and triple by 2050. Moreover, commercial aviation provides numerous societal and economic benefits, making it impractical to scale down commercial flights.

What options are there for decarbonization in aviation?

Currently, there are three main candidates for decarbonizing aviation: battery-powered cells, the use of hydrogen either through direct combustion or fuel cells, and sustainable aviation fuels (SAFs).

Electrification

The primary constraint with batteries is their specific energy density, which directly impacts the weight of the aircraft. Current lithium batteries have an energy density of 200 Wh/kg, which is 50 times less than the 10 KWh in each kilogram of kerosene. Even with combustion and mechanical inefficiencies accounting for a two-thirds energy loss, there remains a fifteen-fold difference. This disparity is challenging to overcome, even as battery technology improves rapidly. These weight considerations make batteries impractical for a typical single-body aircraft like an A320, where a three-hour flight burns over 6 tonnes of kerosene. Replacing this with commercially available batteries would require over 90 tonnes of battery cells, exceeding the aircraft's maximum take-off weight.

Additionally, as airplanes burn fuel, they gradually lose weight, which is crucial for long-haul flights. This characteristic means batteries will likely only be suitable for short-haul flights, despite their notable improvements and reduced complexity and maintenance costs. However, since 80% of emissions come from flights over 1.500 km, the impact of battery-powered aviation will be relatively limited. Furthermore, issues such as battery degradation and charging times must be addressed before commercial implementation.

One of the first battery powered aircraft will be the Aura Aero Era, whose first flight is scheduled for 2026. This aircraft is expected to be able to transport 19 passengers with a range of 200 NM.

2. Hydrogen

Hydrogen has great potential due to its outstanding specific energy density (over 33 KWh/kg) and weightlessness, making it an ideal candidate for decarbonizing aviation. The only byproduct of hydrogen combustion or fuel cell power generation is water. Airbus has already invested in hydrogen-powered aircraft with the ZEROe project, exploring three configurations to bring hydrogen-powered aircraft to market by 2035. This aircraft will be able to transport almost 100 passengers for a range of 1.000 NM.

Hydrogen combustion through gas turbines allows greater thrust levels, while hydrogen fuel cells, which power electric motors, are more efficient but currently constrained in terms of maximum power outputs. Both technologies can be complementary, with propulsion systems chosen based on the flight phase.

However, several challenges hinder hydrogen's implementation in aviation. While hydrogen's lightness is advantageous, its very low density, even under high pressures or cryogenic conditions, makes it difficult to store under the wings (except for Blended Wing Body aircraft, but implementing multiple technological shifts simultaneously is unlikely). Even in cryogenic conditions, hydrogen's volumetric energy density is four times less than that of kerosene. Storing fuel inside the wings is a refined aviation solution with multiple benefits: it maximizes payload space in the fuselage, reduces the bending moment on the wing root, and avoids having to excessively deflect the control surfaces when consuming fuel, reducing the aerodynamic resistance of the aircraft.

Storing liquid hydrogen in the rear pressure bulkhead seems the most feasible option, but it reduces passenger rows, making it less attractive for airlines and potentially increasing ticket prices. Another major disadvantage is the lack of infrastructure, including airport, transport, and distribution systems, which requires substantial investments. Handling hydrogen is complicated by its extreme flammability, invisible flame, and odorless gas, with odorizing agents being incompatible due to contamination or solidification issues.

Finally, 99% of current hydrogen production comes from coal gasification or methane steam reforming, resulting in over 1.000 million tonnes of CO2 equivalent annually. Green hydrogen produced through electrolysis appears to be the best solution, but it currently represents only 1% of worldwide production. Scaling up low-cost renewable energy and developing cheaper, more efficient electrolysers could reduce the cost of green hydrogen, but it remains significantly more expensive than fossil fuel-based grey hydrogen.

3. SAFs

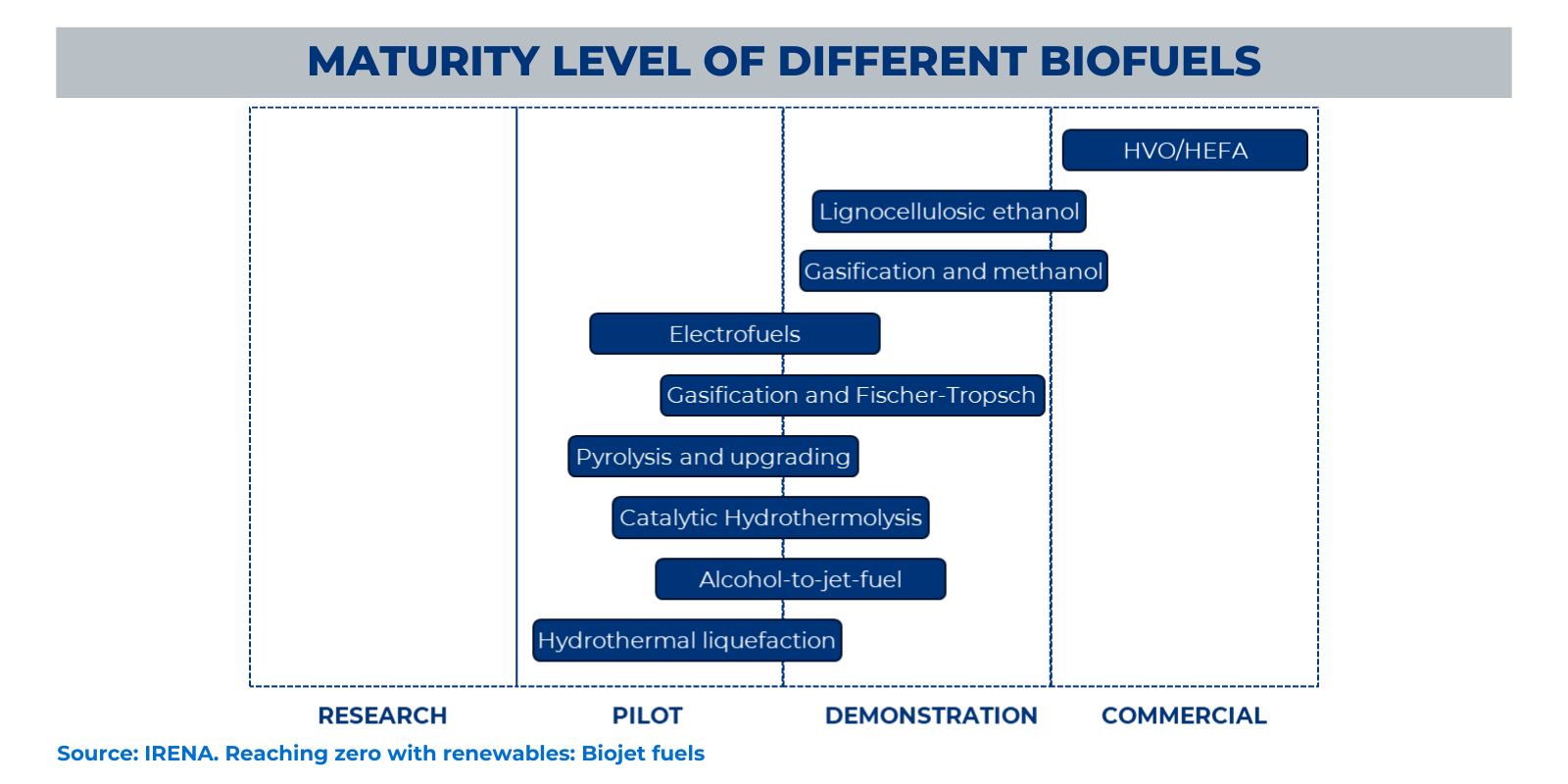

Synthetic aviation fuels (SAFs) are aviation fuels similar to kerosene but fully derived from synthetic components made from various feedstocks. There are two main types of SAFs:

- Biofuels: Biofuels are derived from biomass, which can include vegetable oils, animal fats, and various plant-based feedstocks.

- Synthetic Fuels (E-fuels): Synthetic fuels are synthesized from hydrogen and carbon. When e-fuels are produced using green hydrogen and carbon capture, they can be nearly carbon-neutral. These fuels offer the greatest potential for decarbonization and scalability, though they come at the highest cost.

Feedstocks determine the final impact of the fuel in terms of land use and climate emissions. The largest and most commercially available type of current production is HEFAs (Hydrotreated Esters and Fatty Acids), produced by refining cooking oils and animal fats through hydroforming. However, their limited availability prevents scaling this category for wide adoption. Advanced biofuels can be produced from forestry residues and municipal waste, avoiding direct competition for land use. However, they also have limited potential for future growth. Alcohol-to-jet fuel converts widely available bioethanol into SAFs by joining molecules and removing oxygen, as ethanol is unsuitable for aviation due to its shorter and more volatile hydrocarbon chains, which result in a lower flashpoint. This option could also pose problems related to land use transformation, as increased demand for bioethanol might arise.

Conventional aviation fuels (CAFs) such as kerosene produce carbon dioxide at every stage of their life cycle, including extraction, processing, transportation, and consumption. In contrast, sustainably produced fuels absorb carbon dioxide during their production as the feedstock grows, potentially reducing life cycle emissions by up to 80% compared to kerosene. As production scales, these fuels can be blended with kerosene to reduce overall emissions, which is key to their midterm implementation. This approach helps moderate ticket price inflation, though the recent trend of decreasing ticket prices may be challenging to maintain, as SAFs are currently three times more expensive than kerosene.

Several parameters need to be evaluated for SAFs. According to IATA, key metrics include:

- Lifecycle carbon emissions

- Direct and indirect land use change

- Water, air, and soil considerations

- Fertilizer and pesticide management

- Waste management

Sustainable aviation fuels are complex, and analyzing each step of their production and overall impact is vital to ensure they effectively reduce emissions.

Currently, SAFs represent less than 0.1% of all aviation fuel. However, in 2023, the European Union agreed on the ReFuelEU Aviation mandate, requiring blends of sustainable aviation fuels with kerosene starting at 2% of total fuel supplied in 2025, increasing to 70% by 2050. This mandate covers biofuels, recycled carbon fuels, and synthetic aviation fuels (e-fuels), but notably excludes food and feed crops to avoid compromising sustainability goals, particularly if land converted for biofuel production was previously highly biodiverse. Similarly, the Inflation Reduction Act (2022) in the United States provides substantial support for SAF production with tax credits and grants of 0.33 USD per liter of SAF produced, provided the lifecycle emissions are less than half those of kerosene.

The main advantage of biofuels and synthetic drop-in fuels is their compatibility with existing infrastructure, including pipelines, aircraft, and jet engines. There is currently a 50% blending limit due to the lack of aromatic hydrocarbons, which are necessary for sealing and lubricating, but jet engines could be adapted to work with 100% SAF composition. Airbus and Boeing have promised full SAF compatibility with all their aircraft by 2030. The variety of SAF options and their compatibility with current infrastructure make them a realistic midterm solution, even with significant price hikes. As production increases, prices are expected to decrease.

Another benefit of SAFs is their relative or complete lack of aromatic hydrocarbons compared to kerosene. Reduced sulfur and aromatic content leads to lower particulate matter emissions, especially at low engine power during taxiing, improving local air quality.

Airlines are particularly sensitive to fuel prices, as they represent a quarter of their operating expenses. An indirect consequence of implementing SAFs, which would increase fuel prices, is the extension of routes where airlines perform fuel tankering. Fuel tankering involves carrying more fuel than necessary to avoid refueling at more expensive locations, which increases fuel burn and emissions due to the additional weight. Price hikes could make this practice more common, which is why it is specifically targeted in the European SAF mandate.

Future outlook

Although it is difficult to predict how the industry will evolve in the coming years, pressures to decarbonize will certainly lead to changes despite remaining techno-economic barriers.

Sustainable fuels appear to be one of the main tools for reducing emissions in the mid to long term as hydrogen technologies continue to develop. While price remains a significant hurdle, technological advancements in the coming years, such as trussed wings that allow higher aspect ratios and improved aerodynamic efficiencies, and ultra-high bypass ratio engines like open fans, could make increased fuel prices more manageable.

The main challenge with SAFs remains scaling feedstocks sustainably to ensure production and price goals are met. As large-scale investments and production advance, costs will decrease, making SAFs a more competitive and appealing option for airlines. However, SAFs will have to compete with alternatives like ICAO’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). Offsets can be cheaper than using biofuels, potentially hindering wider adoption. While buying credits from projects in other sectors is positive, true transition towards green aviation will require integrating SAFs and hydrogen technologies.