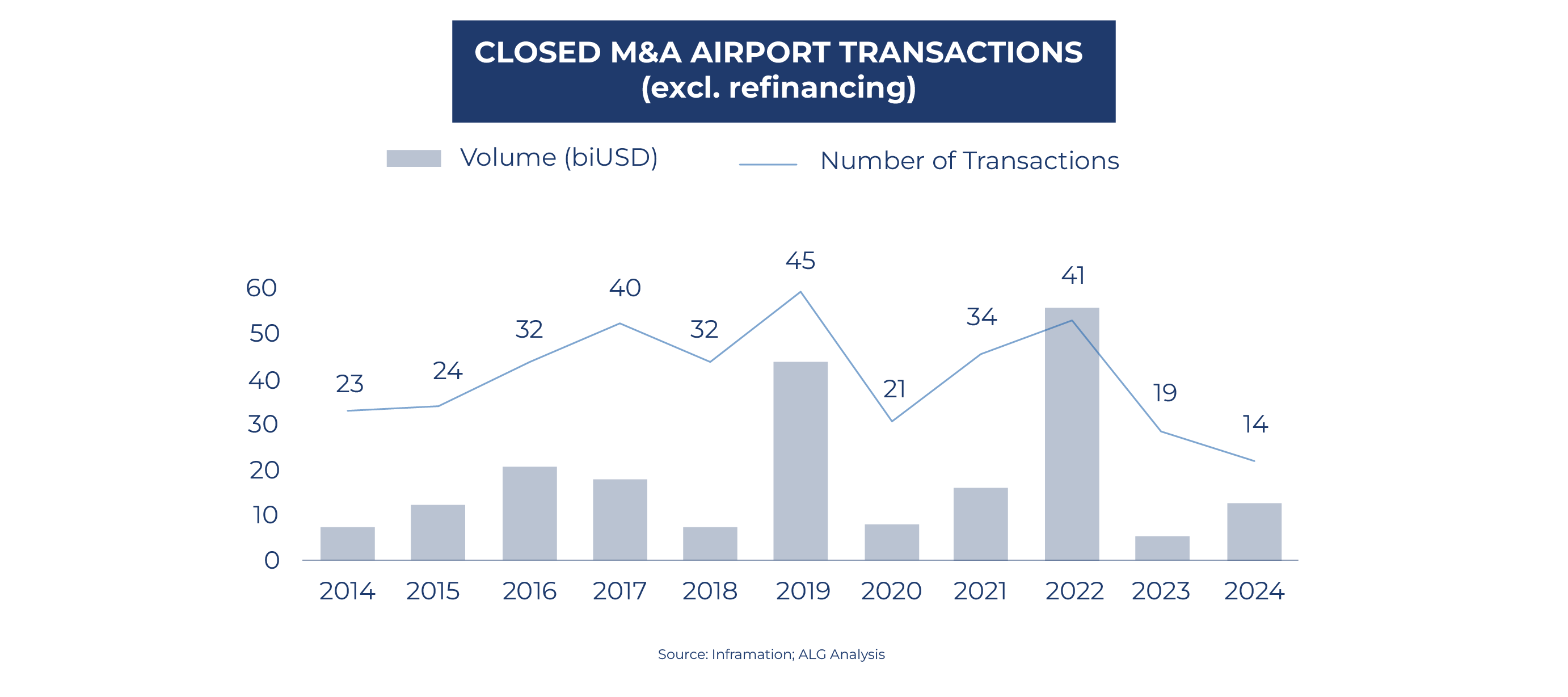

Airports, as gateways to the world, connect cities, fuel trade, and drive tourism. Yet, they are much more than transit hubs—they are powerful economic engines. In 2024 alone, global airport M&A deals surpassed 12.3 biUSD across some 14 different deals. Nevertheless, these results are far from peak figures achieved during 2022, where closed airport transactions exceeded 55.6 biUSD in 41 different transactions, driven by an adjusting post-COVID-19 scenario.

Before the pandemic, the airport sector had already been an attractive investment, with deals focused on privatization, expansion, and modernization. In 2019, there were high-profile transactions - especially in Asia - such as the privatization of New Chitose Airport in Japan, the development of Ezhou Airport, or the expansion of Urumqi Diwopu International Airport, both in China. In the UK, London Gatwick reflected ongoing global interest in airport assets.

Before the pandemic, the airport sector had already been an attractive investment, with deals focused on privatization, expansion, and modernization. In 2019, there were high-profile transactions - especially in Asia - such as the privatization of New Chitose Airport in Japan, the development of Ezhou Airport, or the expansion of Urumqi Diwopu International Airport, both in China. In the UK, London Gatwick reflected ongoing global interest in airport assets.

However, the COVID-19 pandemic in 2020 drastically impacted airport operations worldwide, with international travel coming to a near halt. This led to a sharp decline in M&A activity, as airports faced financial challenges and were focused on surviving the crisis rather than pursuing large-scale transactions. By 2022, the airport sector had begun to recover as global air traffic rebounded from the worst of the pandemic. Airport M&A activity surged back, featuring the 23,420 biUSD Sydney Airport sale, the Vienna Airport sale, and important greenfield projects like the JFK New Terminal One (NTO) redevelopment and expansion of Terminals 6 and 7.

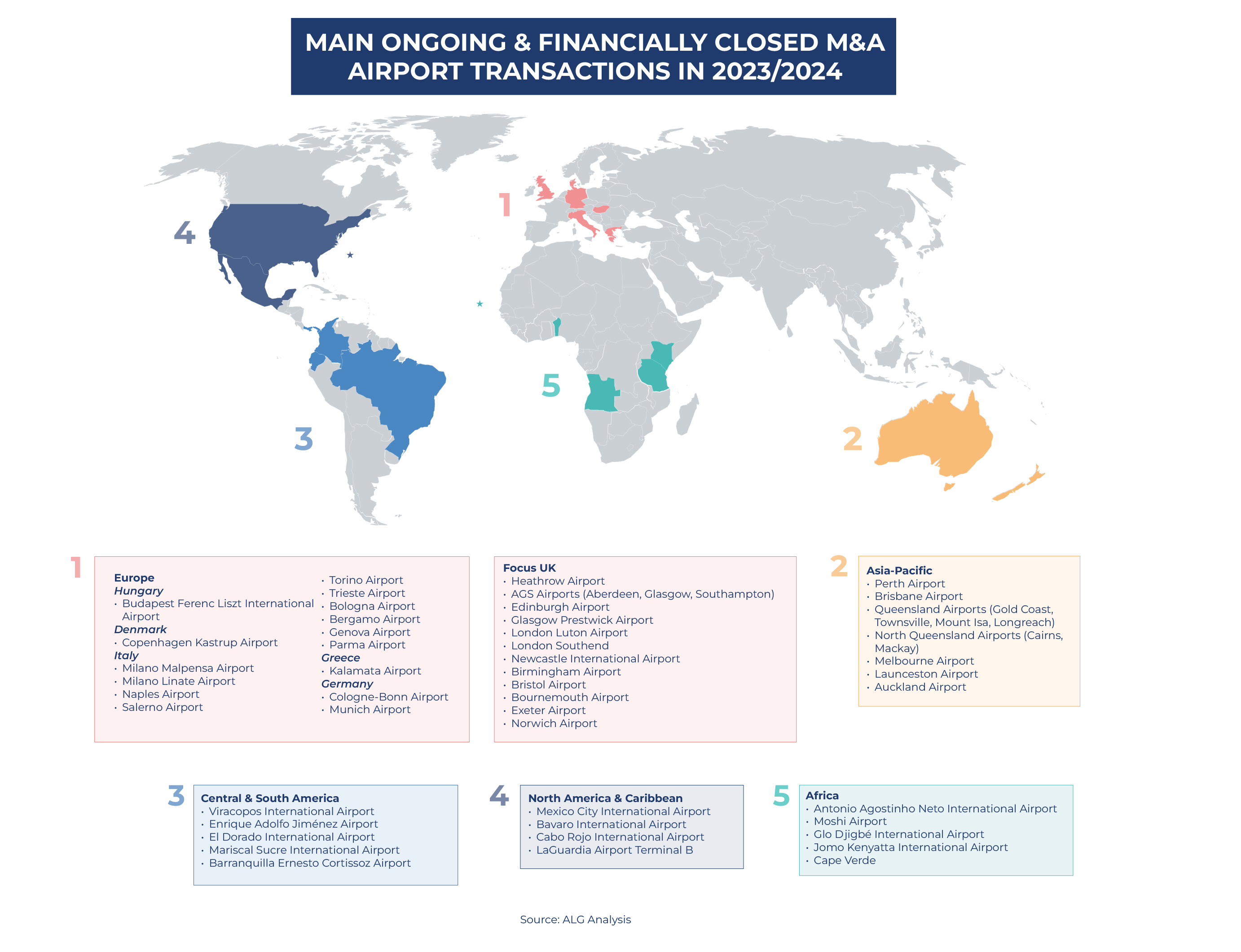

Recent and relevant M&A transactions in the airport sector will be analyzed by continent, focusing on the strategies of key stakeholders and outlining expectations for the upcoming year.

Europe

Europe has been a focal point for significant airport transactions this year, led by the sale of Budapest Airport and of Ferrovial’s stake in Heathrow Airport. In the United Kingdom, transactions have centered on the London airport system, along with medium-sized airports such as Glasgow and Edinburgh, and smaller domestic airports. Italy has also seen activity through 2i Aeroporti, while Copenhagen Airport has undergone nationalization, and privatization efforts continue for German airports.

Hungary: Budapest Ferenc Liszt Airport

GIC, Caisse de dépôt et placement du Québec (CDPQ), and AviAlliance - the latter having recently invested in AGS Airports - have divested their 100% stake in Budapest Ferenc Liszt International Airport (BUD; 16.0 Mpax in 2019). The buyers include Corvinus, a Hungarian state-owned entity holding an 80% stake, and VINCI Airports, which acquired the remaining 20% and will manage the airport's operations. The deal, valued at an enterprise value of 4.3 biEUR, reflects an EBITDA multiple exceeding 20 times, making it the largest financially closed airport transaction of 2024. With this move, AviAlliance continues strategically reorganizing, featuring the divestment from Budapest Airport, a new commitment to AGS airports, an increased stake in Athens International Airport, and a challenging regional aviation environment in Germany.

Budapest Airport (Source: Vinci Concessions)

United Kingdom

It's worth considering whether the UK's post-Brexit environment influenced some of the following decisions, with investors seeking more attractive and profitable growth opportunities in other markets. Infrastructure operators seem to be keen to exit mature assets and free up capital to pursue more lucrative opportunities. However, high multiples achieved in these sales suggest that UK airport assets continue to be highly attractive to investors seeking stable, long-term cash flows.

London Heathrow & AGS Airports (Aberdeen, Glasgow, and Southampton)

The UK airport sector has been at the forefront of M&A activity during 2023 and 2024. Two major transactions involve Ferrovial, the global infrastructure operator based in Spain that specializes in the development, construction, and management of transport infrastructure. Ferrovial recently undertook significant divestments in its UK airport assets, including the sale of 19.75% of its 25% stake in Heathrow Airport Holdings (LHR; 79.2 Mpax in 2023). This transaction also incorporated the stakes held by GIC and Caisse de dépôt et placement du Québec (CDPQ), which exercised their tag-along rights, collectively increasing the total stake sold to 35%. The sale, valued at 2 biUSD, was made to Ardian Infrastructure Fund VI (AIF VI) and the Public Investment Fund (PIF) of Saudi Arabia. Following this transaction, Ferrovial's remaining stake in Heathrow Airport has been reduced to 5.25%.

Heathrow Airport T5 (Source: Heathrow)

In November 2024, Ferrovial also agreed to sell its 50% stake in AGS Airports (Aberdeen, Glasgow, and Southampton; combined total of 15.5 Mpax in 2023) to Avialliance. This transaction is expected to generate a capital gain of approximately 290 mEUR. These divestments appear to align with Ferrovial's strategy to refocus on the U.S. market and allocate resources toward new projects with long-term growth opportunities, both of which could be achieved by leveraging the liquidity generated from these sales.

Edinburgh Airport & Glasgow Prestwick Airports

The sale of AGS Airports follows closely the earlier sale of Global Infrastructure Partners II (GIP II) 50.10% stake of Edinburgh Airport, Glasgow Airport’s close competitor, to Vinci for 1.27 bi GBP, equivalent to an EV/EBITDA multiple of just over 20 times.

Other United Kingdom Airports

In the London airport systems, Spanish airport operator Aena, majority-owned by the Spanish government, faces potential disruption as US energy group NextEra Energy seeks to seize control over a 26.01% stake in London Luton Airport (LTN; 18.5 Mpax in 2023). Several years ago, Spain implemented cuts to renewable energy subsidies, leading to an arbitration ruling that awarded NextEra 290 mUSD in compensation. As the Spanish government has yet to fulfill this payment, NextEra is pursuing enforcement by targeting Aena’s stake in London Luton Airport.

Italian Airports: Milano Malpensa, Linate, Naples, Salerno, Torino, Trieste, Bologna, Bergamo and Genova Airports

Italy has also been notable in M&A activity in recent years. A 49% stake in 2i Aeroporti was sold for 842 mUSD in November 2024 to Asterion Industrial Partners, an independent investment management firm specializing in infrastructure investments across Europe’s mid-market. 2i Aeroporti holds both direct and indirect stakes in several major airports, including Milano Malpensa and Linate, Naples, Salerno (which recently opened to commercial aviation), Torino, Trieste, Bologna, and Bergamo. Together, these airports represent over 32% of passenger traffic (63 Mpax) and around 70% of cargo (758 ktons) in Italy as of 2023. Although Asterion already had a significant presence in Italy, this deal marked its first venture into the airport sector. A 51% stake of Parma’s airport was also sold to Canadian aviation firm Centerline Airport Partners.

Looking Ahead: European Airports

Additionally, in 2025, we may witness the sale of Ontario Teachers' Pension Plan (OTPP) airports, as it has announced its intention to divest from its long-held stakes in Brussels, Copenhagen Kastrup, Birmingham, Bristol, and London City. This decision may be driven by various factors: the successful sale of AGS airports, the timing being right for such deals, and broader global trends, such as Canada's efforts to encourage pension funds to invest in domestic infrastructure. In parallel, the Danish Government plans to acquire a majority stake from ATP and OTPP in Copenhagen Kastrup Airport (CPH; 26.8 Mpax in 2024). By purchasing an additional 59.4% stake, the state's ownership of the airport would be increased to approximately 98%. This nationalization deal is valued at 4,518 mUSD.

The German government is exploring the sale of minority stakes in Cologne-Bonn Airport and Munich Airport (in which they currently own a 31% and 26% stake, respectively), reflecting its ongoing efforts to reduce public ownership of assets better managed privately. These events occur as Germany faces a challenging economic, political, and social environment.

Additionally, Esken Limited is exploring a sale of London Southend Airport (SEN; 1.2 Mpax in 2023), where US private equity giant Carlyle Group could be trying to convert a 125 mGBP loan into a 30% stake in the airport. Other transactions in early phases include the sale of 49% stake in Newcastle International Airport (NCL; 5.5 Mpax in 2023); minority stakes in the Birmingham (BHX; 14.5 Mpax in 2023) and Bristol Airports (BRS; 9.0 Mpax in 2023) and different transaction options for Bournemouth Airport (BOH; 1.0 Mpax in 2023), Exeter Airport (EXT; 1.5 Mpax in 2023) and Norwich Airport (NWI; 0.3 Mpax in 2023).

In Montenegro, the government, with support from the IFC, has entered the second stage of the tender process for a 30-year concession to operate the country’s two international airports, Podgorica and Tivat.

In Greece, Fraport is seeking to expand its Greek portfolio with the 40-year concession of Kalamata Airport. At the same time, the Luxembourg-based Marguerite Fund is selling its 10% stake in Fraport Greece, the owner and operator of 14 airports in Greece, for 108 mUSD.

In Italy, activity includes the 88% stake sale of SAVE Group Airport Concessionaire (Venice and Treviso Airports), the privatization of Falcone Borsellino Airport in Palermo, the sale of Aeroporti di Puglia (Bari, Brindisi and Foggia airports) and the sale of a 15% stake of Genova Airport to Mediterranean Shipping Company (MSC), to be closed soon.

In France, the financial close for the new concession for Paris-Beauvais Airport is due to reach financial close imminently (with capex requirements of approx. 243.7 mUSD).

Several major airport transactions remain in early stages but continue to progress, including the PPP for the Novo Aeroporto de Lisboa (NAL), valued at 6.2 bUSD, and the sale of a 49% stake in the construction of the new Warsaw airport, a project worth 1.9 bUSD. Additionally, the long-debated third runway at Heathrow, with an estimated cost of £14 billion, remains a key project under discussion.

Asia-Pacific

The Asia-Pacific region has experienced only a handful of transactions at financial close during 2024, including smaller PPPs and stake sales (under 10%) in India. The latter are related to the Bhogapuram International Airport PPP Stake Sale (for 47 mUSD) and the acquisition of a 10% stake of Bangalore International Airport by Fairfax India Holdings Corporation from Siemens Project Ventures, valued at 253.39 mUSD.

Looking Ahead: Asia-Pacific Region

Although activity remained subdued in 2024 for the Asia-Pacific region, years from 2025 and beyond are expected to see major activity and growth, with most upcoming transactions to be carried out in these regions.

Australian Airports

In Australia, M&A activity seems to have picked up again following one of the most significant airport sector transactions—the 2022 acquisition of Sydney Airport by a consortium led by a major Australian investor. After this landmark deal, the market remained quiet until recently. Australia’s unique landscape features airports partially owned by pension funds, many of which are undergoing mergers. These mergers, combined with portfolio adjustments, could drive further airport sales.

The sale of Queensland Airports -one of TIF’s key assets- was initiated this 2024. It includes Gold Coast Airport (OOL, the fund’s primary asset and the sixth busiest airport in the country), Townsville (TSV), Mount Isa (ISA), and Longreach (LRE) airports. TIF’s 74% controlling stake is to be acquired by a consortium led by KKR and Skip Capital for 2 biUSD, marking the first airport investment for KKR in its almost 50-year history.

Also, the 100% stake in North Queensland Airports (with a deal value of 1.95 biUSD), is currently in the expression of interest (EOI) stage, comprising of Cairns and Mackay Airports (which together serve around five million passengers per year).

Other ongoing transactions include the recent sale launch of the 9.7% stake in Australia Pacific Airports Corporation (APAC) -which includes Melbourne and Launceston airports- and the agreement of AustralianSuper to acquire a 15% stake in Perth Airport from Utilities Trust of Australia (UTA).

Gold Coast Airport (Source: Australian Aviation)

Other activities in Asia

In this context, the divestment activities of major airport operator Fraport stand out as it reshapes its global growth strategy. The company has been selling its stakes in Asian countries, including:

- A 10% stake in Delhi Airport (DEL) to its majority owner GMR Airports Infrastructure, for 126 mUSD.

- A 25% stake in St. Petersburg’s Pulkovo Airport (20.4 Mpax in 2023) to Oman’s Orbit Aviation, following its decision to exit the Russian market in 2022 due to geopolitical challenges. The transaction was concluded in December 2024.

- A 24.5% stake in China’s Xi’an Xianyang International Airport for $174 million, marking the end of its participation in the Chinese market after frustrated efforts to expand its presence in the region.

In the Middle East, the focus remains on greenfield projects (i.e., the new Abha airport in Saudi Arabia), where the number of developments is limited, but each represents substantial investment, reflecting the region's emphasis on large-scale, high-impact infrastructure growth.

In the Philippines, the rehabilitation and expansion of the Manila International Airport in a BoT format is also underway, which will require an estimated CapEx of 3.1 bUSD.

Central & South America

2024 has marked a slowdown in M&A activity across Central and South America’s airport sector, with fewer transactions compared to the consistent deal flow seen over the past decade. Financially closed deals only include greenfield projects, mainly comprising tenders for three airports in Chile: the Carlos Ibáñez Airport and the Balmaceda Aerodrome (162 mUSD) and the Florida Airport third concession (59 mUSD).

Looking Ahead: Central & South America

Regional airports in Panamá, under Tocumen International Airport Administration, are set for privatization in the hope that the private sector can efficiently manage and improve the facilities. Additionally, Macquarie Infrastructure Partners V seeks to acquire a 50% stake in Grupo Argos and Odinsa’s airport investments, including Colombia’s El Dorado International Airport in Bogotá (BOG; 35.4 Mpax in 2023) and Ecuador’s Mariscal Sucre International Airport in Quito (UIO; 5.0 Mpax in 2019), for 164 mUSD.

In Latin America, Brazil continues to draw attention following the consolidation of its airport concessions. With most major commercial airports now privatized, the focus has shifted to challenges within earlier concession rounds. Aeroportos Brasil Viracopos (ABV), concessionaire of Viracopos International Airport (VCP; 12.5 Mpax in 2023), decided to return the concession, awarded in 2012, to the government, after facing financial difficulties. The airport is now exploring retendering or a potential sale to maintain operations.

In Colombia, Barranquilla’s Ernesto Cortissoz Airport concession to Grupo Aeroportuario del Caribe was prematurely terminated, as the concessionaire failed to deliver the required infrastructure works. In September 2024, Colombia’s Civil Aviation Authority (Aerocivil) took over the airport’s operations, and now, the National Infrastructure Agency (ANI) is evaluating Private Initiative (PI) proposals, which might indicate an upcoming concession launch.

Additionally, the PPP for the New Airport of Cartagena de Indias remains in its early stages but continues to make progress.

Two other relevant greenfield projects -both at early stages-, include the expansion of Guadalajara International Airport, representing a 1.1 bUSD investment aimed at the construction of a new terminal and ground access; and the expansion of the Alfonso Bonilla Aragón International Airport (Cali) valued at 1.0 bUSD.

North America & Caribbean

In North America, M&A activity in the airport sector has featured few financially closed transactions.

In any case, it is worth noting that, in line with growing interest in the eVTOL sector, a notable late-2024 to early-2025 transaction saw KKR-backed Atlantic Aviation acquire Ferrovial Vertiports for an undisclosed amount. Following the acquisition, Ferrovial Vertiports will operate as VertiPorts by Atlantic, aligning with Atlantic Aviation’s strategic expansion in advanced air mobility.

As for greenfield projects, Macquarie Infrastructure Partners VI (MIP VI) and Porter Aviation will be partnering up to develop the new terminal at Montréal's Saint-Hubert Airport, expected to cost around CAD 200m (USD 152m), which will be able to serve more than 4 million passengers a year.

Looking ahead: North America & Caribbean

In 2025 and the following years, North America and the Caribbean regions will see different transactions, including the acquisition of cargo terminals, corporate hangar facilities, and stakes in airport operator groups, which are currently at their early phases.

In the United States, Skanska has almost finalized the sale of a 32% stake in LaGuardia Airport's Terminal B (LGA) to MI LaGuardia CTB (Meridiam) and Vantage Airport Group for 115 mUSD, increasing their stakes up to 48% and 47%, respectively.

Servicios Aeroportuarios Andinos Global and Grupo CCO are in the process of acquiring a cargo terminal at Mexico City International Airport (MEX), with plans to expand its storage capacity. Meanwhile, Grupo Aeroportuario del Pacífico (GAP), is looking to divest a 5% stake (Aena); while Grupo Aeroportuario del Sureste (ASUR), which operates 12 airports across nine Mexican states, is seeking to sell an 18.5% stake.

In the Caribbean, greenfield airport projects are gaining momentum, particularly in the Dominican Republic. Despite the project facing legal challenges, Grupo Aeroportuario del Sureste (ASUR) has agreed to purchase 25% of the Bavaro International Airport (AIB) greenfield project from Grupo Abrisa for 66 mUSD. Another relevant project is the public-private partnership for the development of Cabo Rojo International Airport, granted by the Dominican Republic PPP General Direction (DGAPP). Also, Providenciales Airport (PLS) PPP, in Turks and Caicos, is progressing.

In Bermuda, Aecon has agreed to sell its stake in the concession for L.F. Wade International Airport (BDA; expected to reach more than 1.0 mSeats in 2024) for approximately 120 mUSD.

Africa

Despite featuring no financially closed transactions during 2024, the African continent has been attracting significant investment, with a focus on modernizing airport facilities and improving air connectivity across the region. In 2023, Cape Verde, the government partnered with Vinci Airports in a concession agreement to develop seven airports across its islands, with a CapEx of 149.6 mUSD. Additionally, Tanzania's Moshi Airport in the Kilimanjaro region is seeking investors for a development project estimated at 32 mUSD.

Looking ahead: Africa

Several public-private partnerships (PPPs) are underway for greenfield projects, including the Antonio Agostinho Neto International Airport in Angola, with an estimated investment of 3 biUSD.

In Benin, the China-Africa Development Fund has made a preliminary decision to invest some 651 mUSD in the Glo Djigbé International Airport PPP. The airport would replace the capital airport, Cotonou Airport (COO; 1.1 Mseats in 2023), following a project from 2018 cancelled during the pandemic.

Additionally, Kenya’s government had been structuring a PPP project for the redevelopment of Nairobi’s outdated and congested Jomo Kenyatta International Airport (NBO).

Overall, M&A transactions are expected to continue throughout 2025, driven by investors adapting their strategies to shifting geopolitical dynamics and the evolving post-COVID environment. We might see a trend of big players moving away from Europe, as Ferrovial and OTPP are doing, and focusing on other markets, such as the Asia-Pacific region and the Americas.