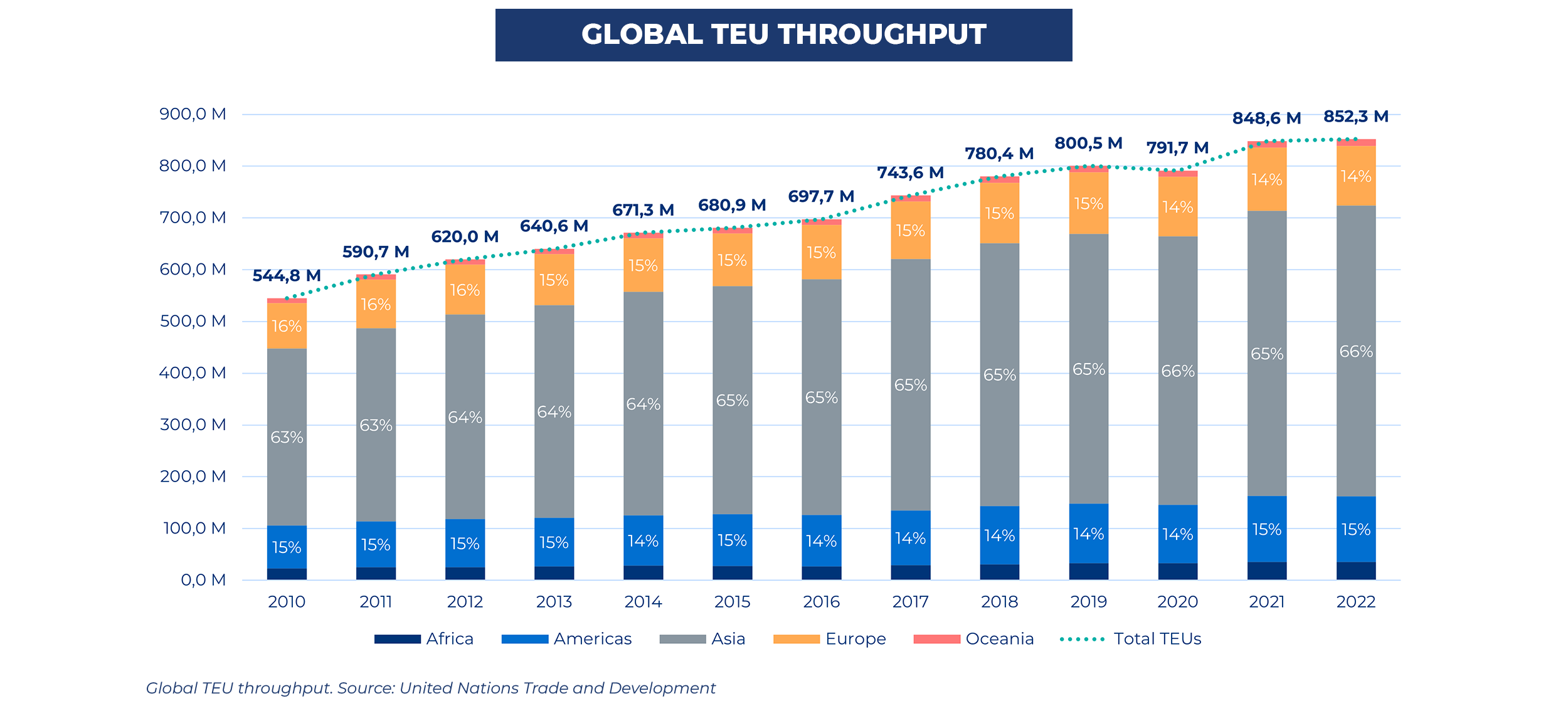

The introduction of containerization in the mid-20th Century revolutionized global trade, making logistics more efficient and significantly reducing costs through the establishment of a standardized unit known as the TEU (Twenty-Foot Equivalent Unit). Since its inception, container shipping traffic has seen continuous growth.

Between 2010 and 2022, global container throughput grew at a compound annual growth rate (CAGR) of 3.8%, highlighting the sustained expansion of maritime trade.

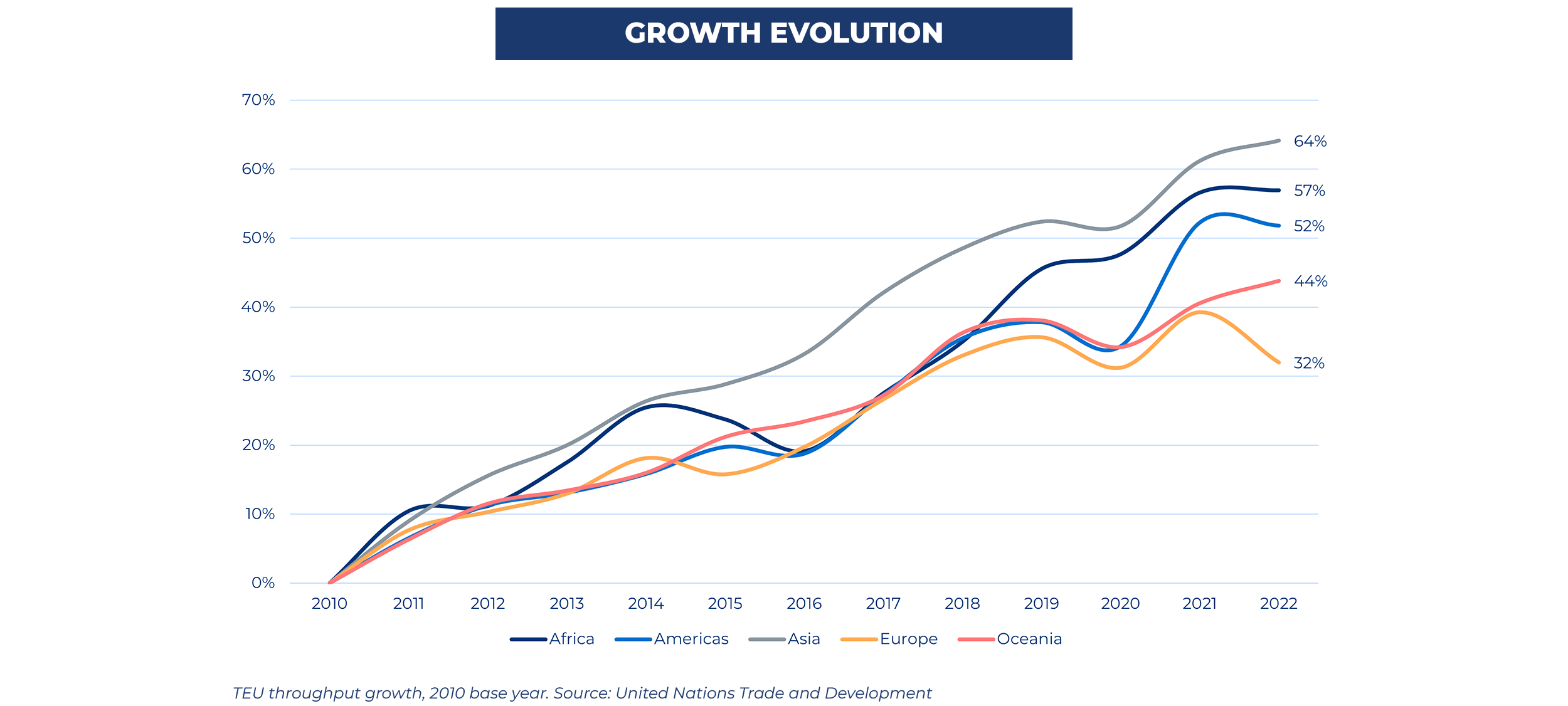

This growth in container traffic has varied significantly across geographies. The following chart illustrates the percentage growth of container traffic in major regions of the world between 2010 and 2022, emphasizing diverse expansion patterns among continents.

As indicated by the data, Asia lead container traffic growth at 64%, closely followed by Africa, which experienced an increase of 57%. This growth in Africa is particularly significant, as it highlights the continent's potential in global trade.

While there have been improvements in Africa’s port and logistics infrastructure, significant gaps remain, positioning the continent as one of the most promising regions for further expansion in the coming years.

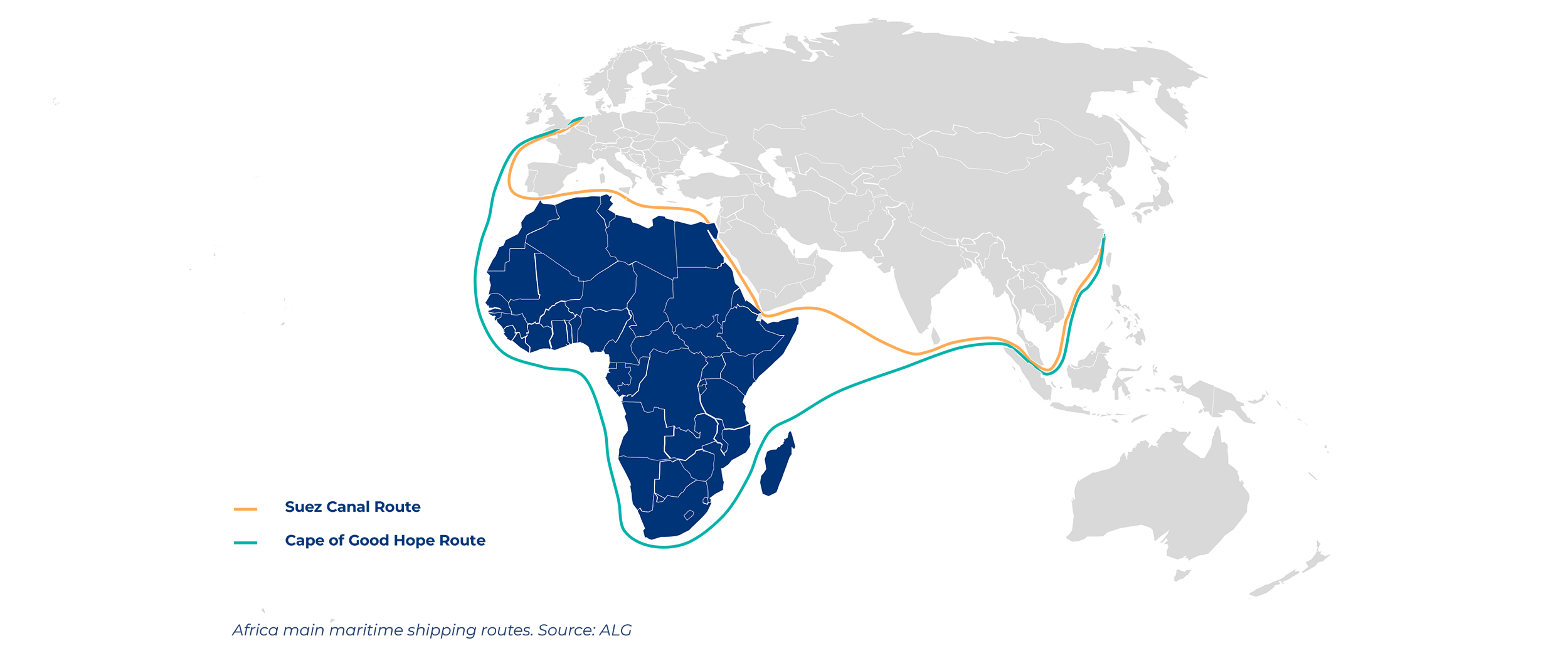

Africa's strategic geographic location plays a crucial role in its potential for growth. The continent lies at the crossroads of major global shipping routes, including the Asia-Europe corridor that passes through the Suez Canal and the Cape of Good Hope. This positions Africa as an essential hub for global container traffic.

However, despite its privileged position, many African port infrastructures require significant improvements to meet the challenges of a growing demand and international disruptions. For example, in November 2023, Houthi forces began attacking ships destined to Israel, later expanding their targets to include all international shipping companies. This led companies with routes through the Suez Canal to reroute southward around the Cape of Good Hope, resulting in delays of approximately 10-15 days for containers traveling from Asia to Europe.

This kind of events, combined with the increasing importance of the African continent in global trade, highlight the need for first class port infrastructures. Furthermore, the increasing demand for intermediary ports along the China-Europe route offers a significant opportunity for Africa. Upgrading its ports could optimize global maritime traffic while allowing African economies to capitalize on their geographic and commercial potential.

Container traffic in Africa

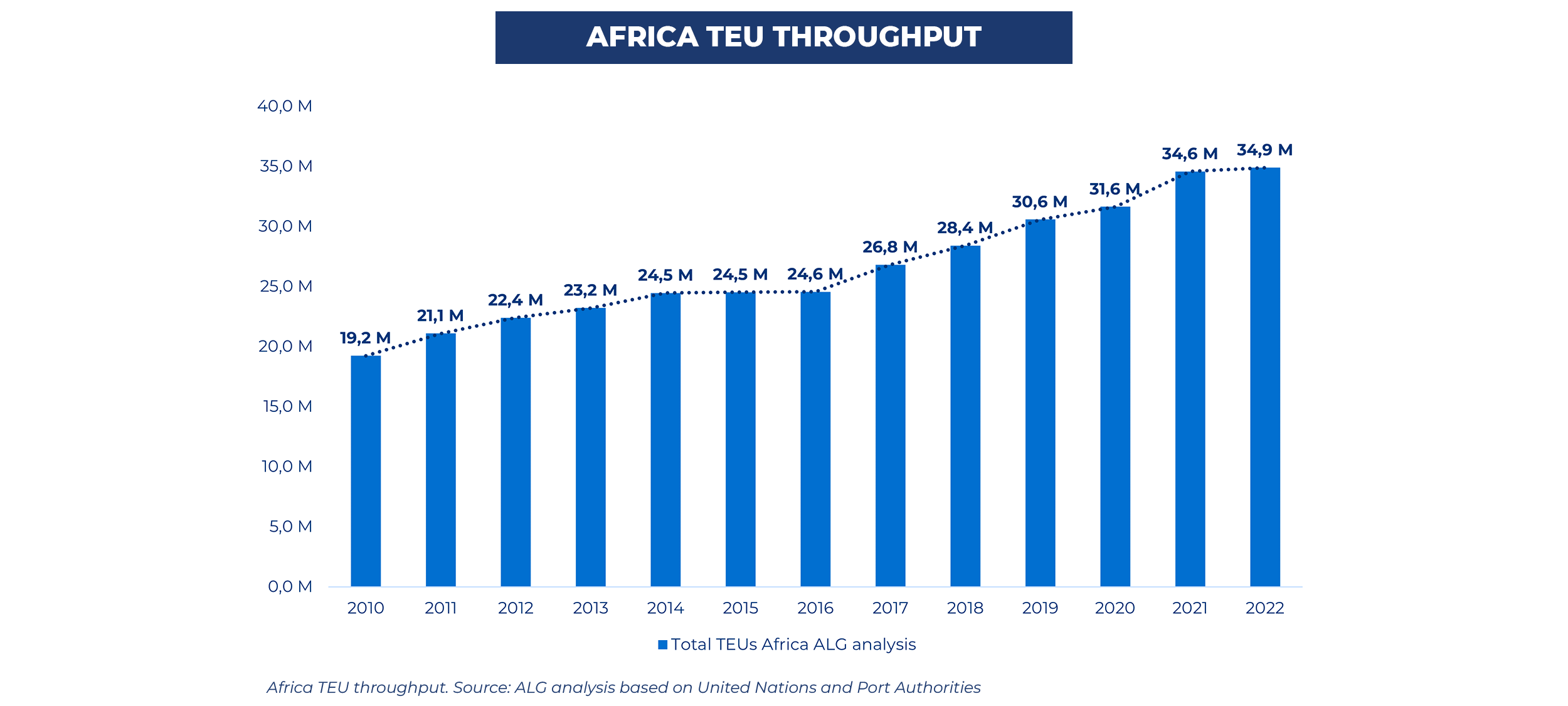

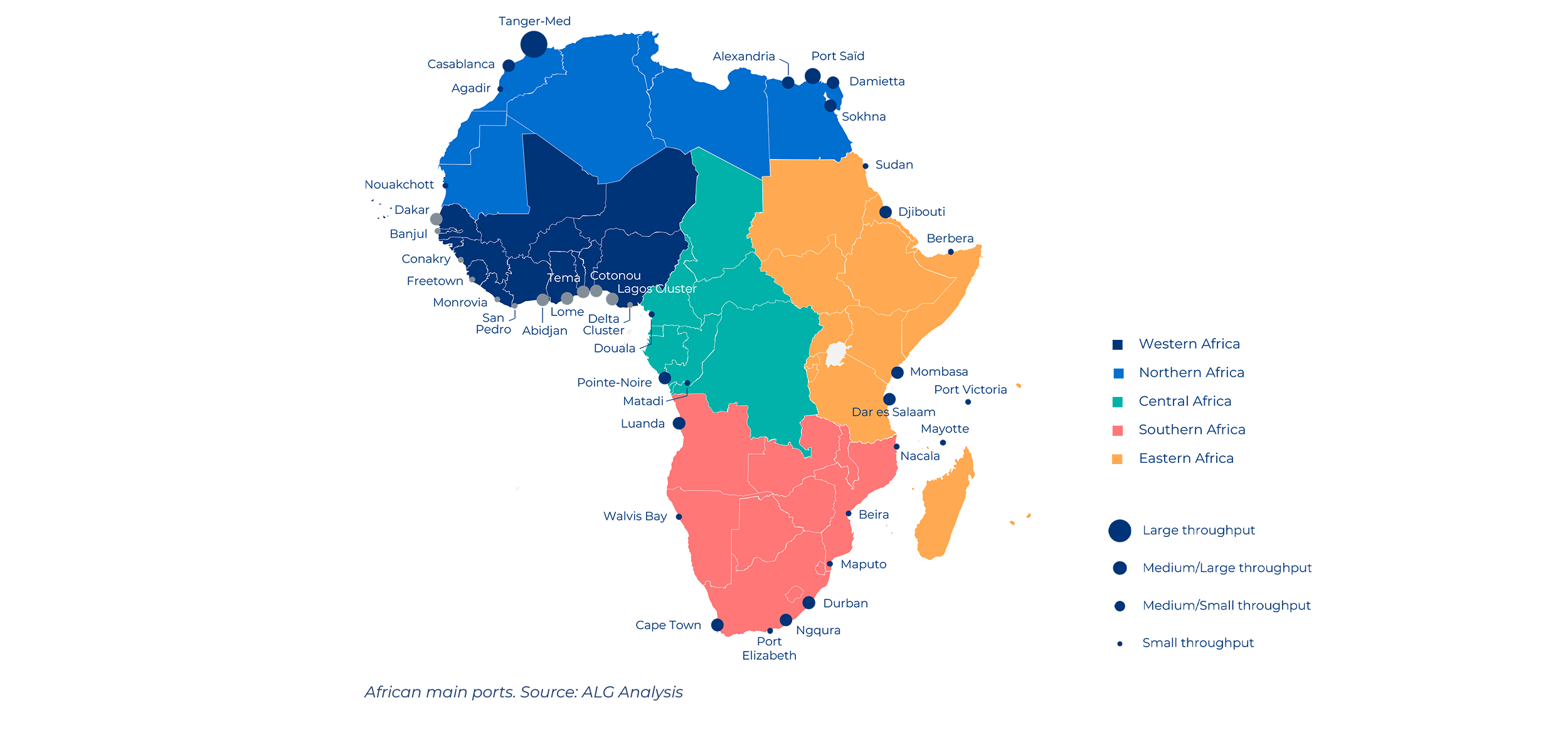

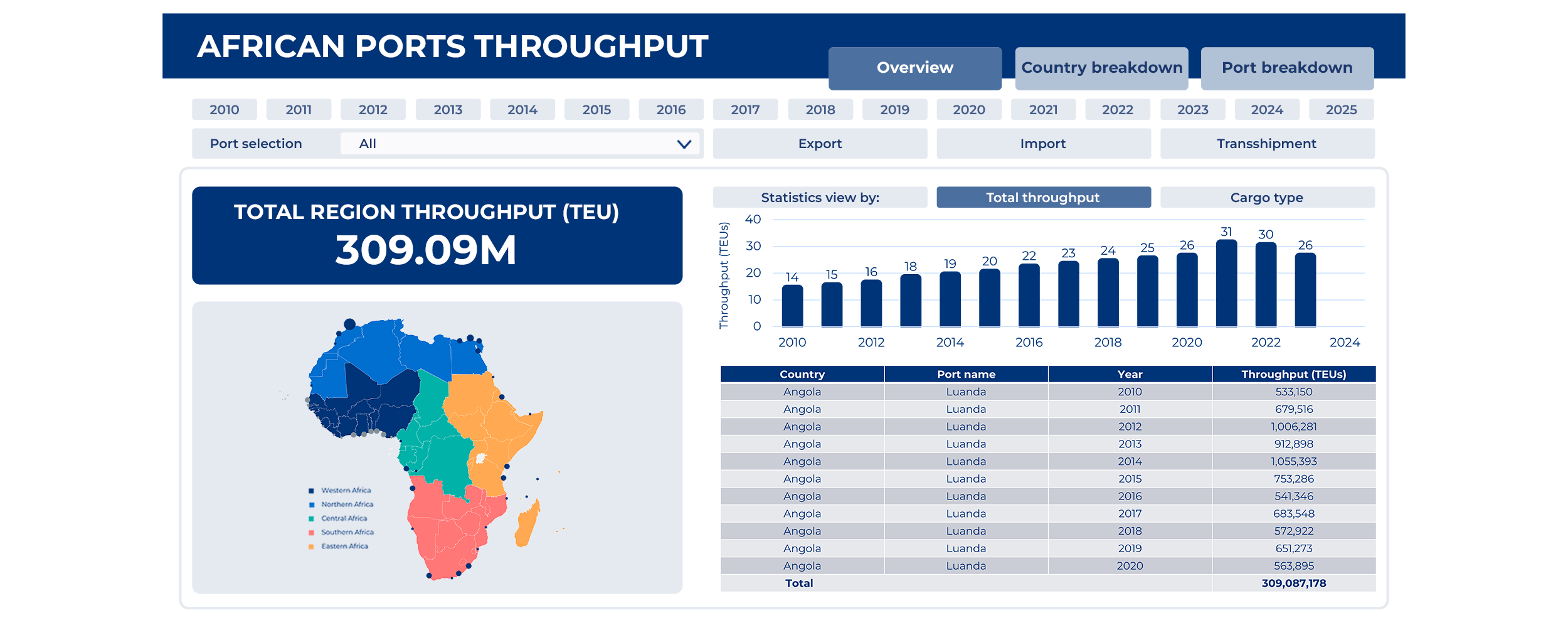

Focusing on container traffic in Africa, ALG has reviewed the main 40 African ports based on container traffic volume and completed TEU throughput data with United Nations Trade and Development proposed container throughput growth rates from 2010 to 2022.

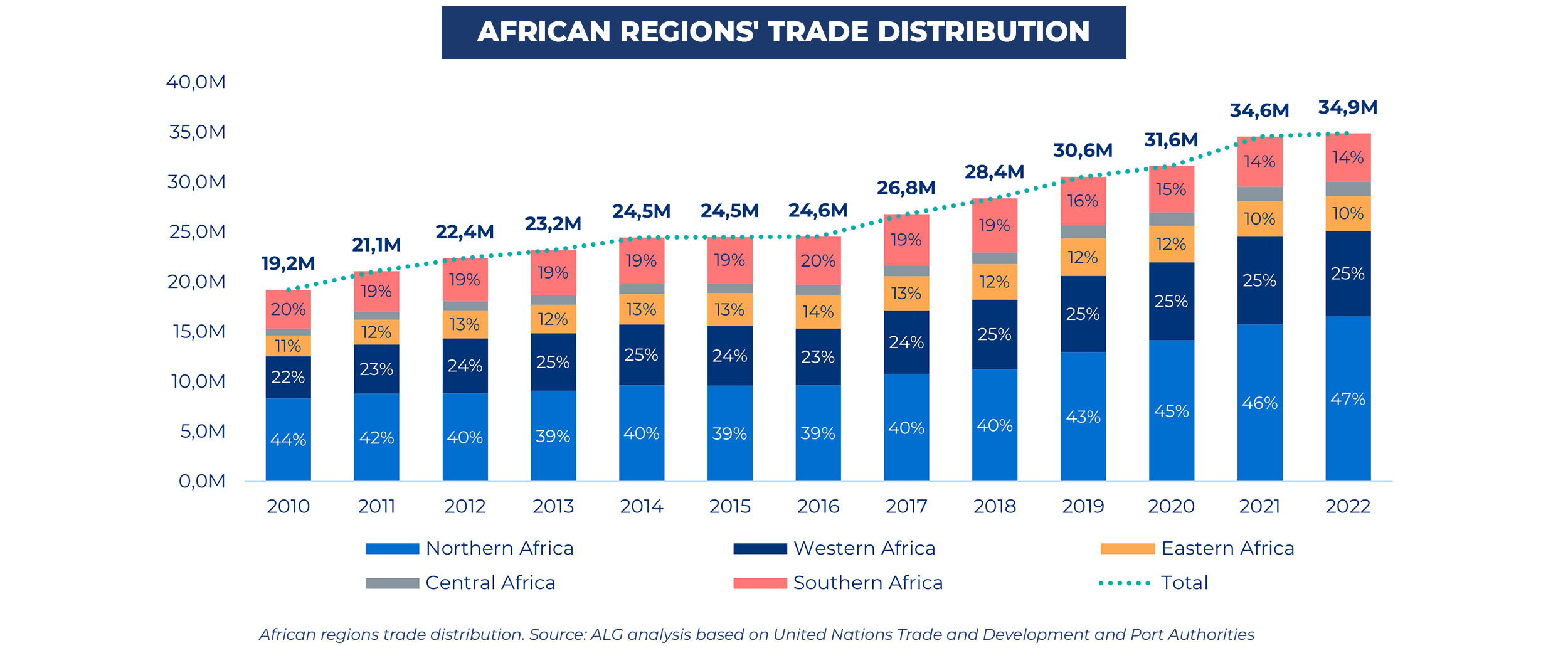

There has been a significant evolution from 19.2M TEUs in 2010 to 34.9M TEUs in 2022, reflecting the continent's growing role in global trade routes. This growth is driven by the contributions of each African region, playing a distinct role in traffic volume. The following map highlights African regions considered by ALG.

Linking to Africa TEU throughput information shown, the following graph illustrates how each region contributes to the continent's total TEU throughput, revealing the distribution of trade traffic across the continent.

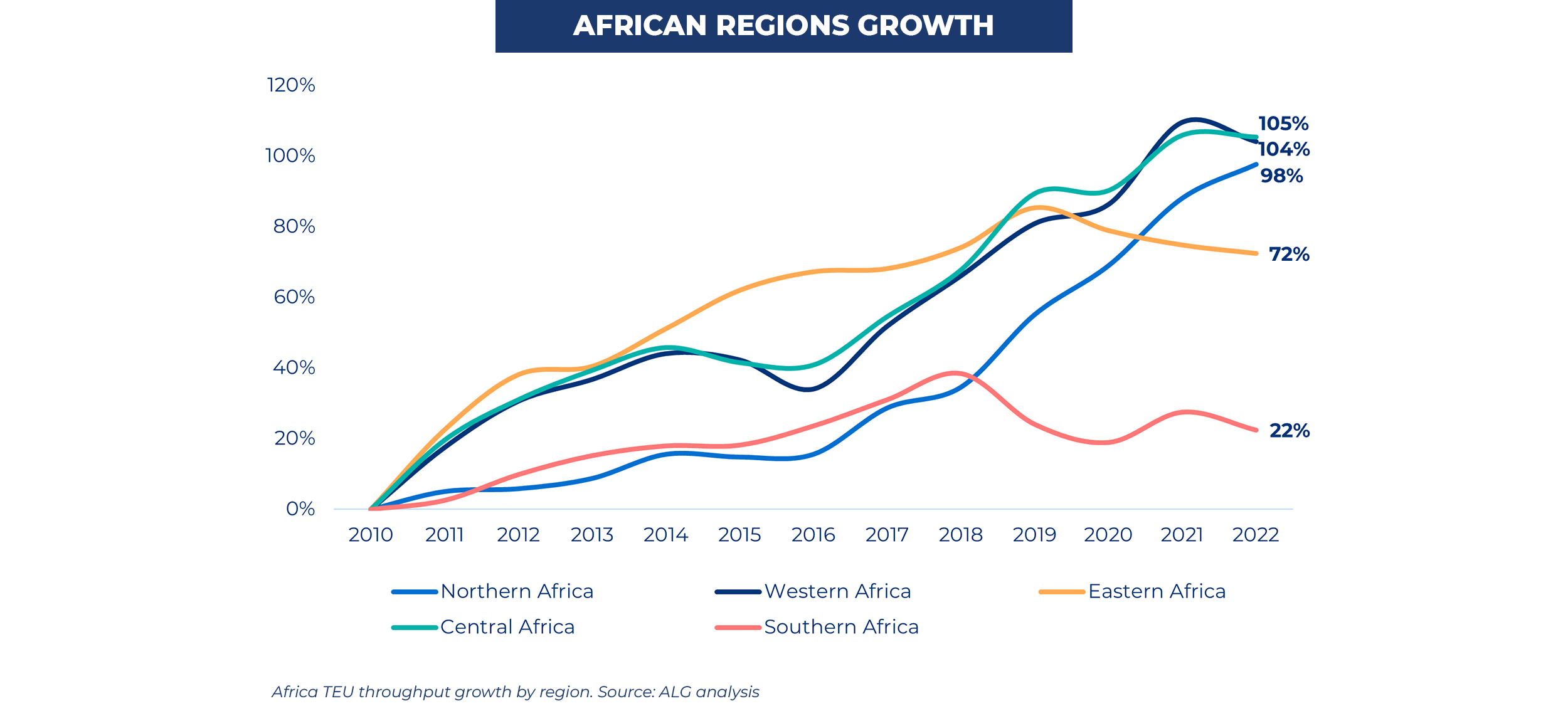

The growth of total container traffic in Africa between 2010 and 2022 has grown year over year, but unevenly across different regions of the continent. The following chart illustrates the cumulative growth in the five main regions of Africa.

ALG analysis shows that the African regions which have experienced the greatest growth are those that have leveraged transshipment traffic as a key driver of expansion.

Regionally, Northern Africa has established itself as the most significant hub for container traffic, accounting for 42% of the continent's total volume. This dominance is primarily due to the strategic importance of the ports of Tanger-Med (Morocco) and Port Said (Egypt).

Both ports stand out not only for their capacity, but also for their location along critical routes such as the Mediterranean and the Suez Canal, making them key nodes for transshipment traffic. Tanger-Med serves as the link for trade between Europe and West Africa, while Port Said, located at the northern entrance of the Suez Canal, facilitates trade between Asia and Europe.

Western Africa, accounting for 26% of the continent's annual TEU volume, hosts the highest concentration of ports. Notably, Lomé (Togo) and Tema (Ghana) which together handle over 3 million TEUs annually. Activity in this region is dominated by the transshipment of goods, particularly at ports like Lomé, which has established itself as a regional hub for container transshipment. On the other hand, in the mid-sized ports of Western Africa, trade focuses on direct imports and exports, reflecting the growing demand for goods and products in local markets.

The Central African region, although it accounts for only 3% of the total TEU traffic on the continent, has experienced one of the highest volume growth rates since 2010. Key ports such as Douala (Cameroon), Pointe-Noire (Republic of the Congo), and Matadi (Democratic Republic of the Congo) are positioning themselves as emerging centers due to economic development and improvements in logistics infrastructure.

Southern Africa region contributes 18% of the continent's total container volume. In this region, the ports of Durban, Cape Town, Ngqura (South Africa), and Luanda (Angola) stand out. Unlike other regions, traffic at these ports is primarily characterized by imports and exports, with a lower percentage of transshipment cargo. Durban, the largest port in South Africa, plays a key role in the distribution of goods not only within the country, but also to other markets in the southern part of the continent. The advanced infrastructure of these ports has enabled the region to position itself as a strategic trade link between Africa, America, and Asia. However, current congestion levels appear to affect their potential to grow.

Finally, Eastern Africa accounts for 12% of the continent's annual TEU volume. The most important ports are Dar es Salaam (Tanzania) and Mombasa (Kenya). Container terminals at those ports are essential for import and export trade, particularly for landlocked countries such as Uganda, Rwanda, and Burundi, which rely on Mombasa for their international trade exchanges. While this region primarily handles import and export goods, significant investments are being made to increase its capacity and compete as a transshipment hub, particularly in Mombasa.

Why ALG?

One of the major challenges ALG has encountered while conducting this analysis is the lack of consistent and reliable data on ports TEU throughput across the African continent. In many regions, data collection is fragmented, with information sourced from multiple channels which, in many cases, is incomplete, inconsistent, or difficult to interpret. This situation complicates informed decision-making for businesses that depend on maritime trade.

Leveraging years of experience in infrastructure projects across Africa and globally, ALG has developed a comprehensive, standardized TEU throughput database. This tool enables us to offer tailored, data-driven solutions that help clients optimize their logistics operations, improve decision-making, and seize opportunities in Africa’s rapidly growing market.

With our tool, ALG can provide ad-hoc solutions quickly and efficiently, helping our clients optimize their logistics operations, make decisions based on solid data, and capitalize on opportunities in a growing market like Africa. With this capability, ALG positions itself as a strategic partner for any company looking to enhance its presence and competitiveness on the continent.