On average, Africa wastes about 50% of its food which is enough to feed 300 million people, due to inefficient supply chain infrastructure, particularly in agriculture. In sub-Saharan Africa, where over 60% of the population are smallholder farmers, inadequate cold chain facilities worsen this issue according to FAO (2020). In addition, cold storages for pharmaceutical products often lack the capacity to store vaccines and temperature-sensitive medicines according to the World Health Organization guidelines, contributing to a global annual death toll of 1.5 million from preventable diseases. By recognizing the critical role of a sustainable cold chain from farm to market, both private and public sectors are increasingly investing in this essential infrastructure in Africa.

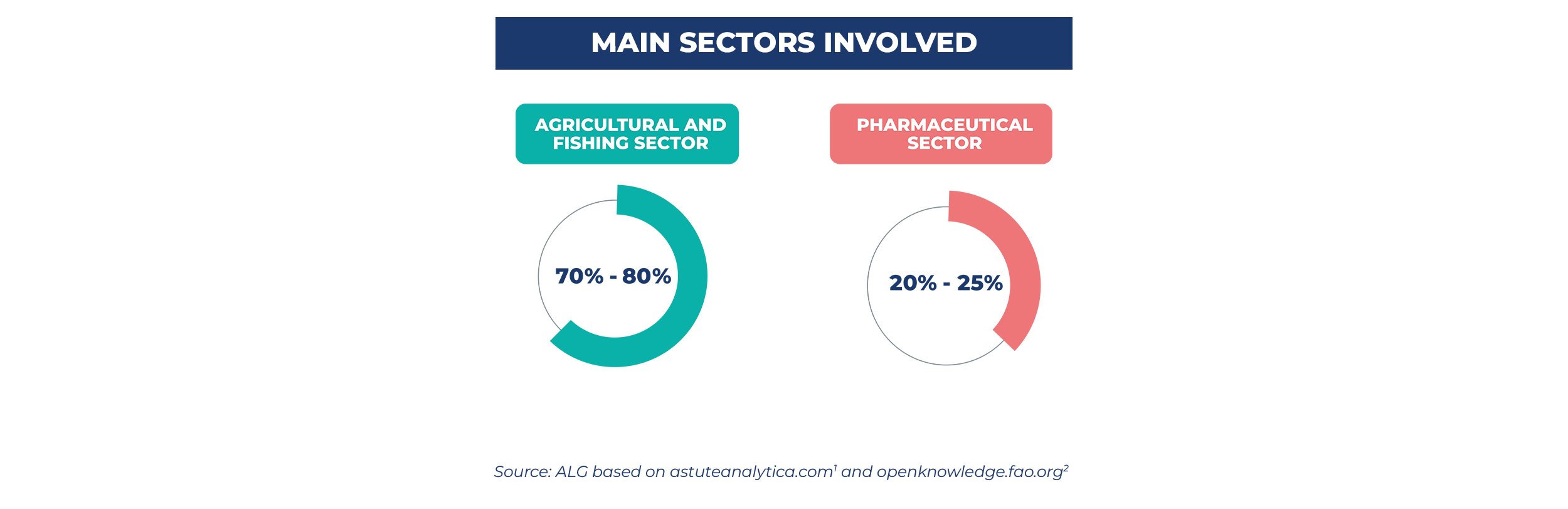

The logistics of maintaining a cold chain is crucial for preserving the quality and safety of perishable and pharmaceutical products. In Africa, the agricultural and fishing sector accounts for approximately 70%-80% of the total of cold storages in the region, while pharmaceutical products make up 20%-25%. However, current capacity is insufficient for regional needs. Expanding cold chain infrastructure is necessary, presenting both significant challenges and potential opportunities.

The role of cold chain logistics in Africa’s development

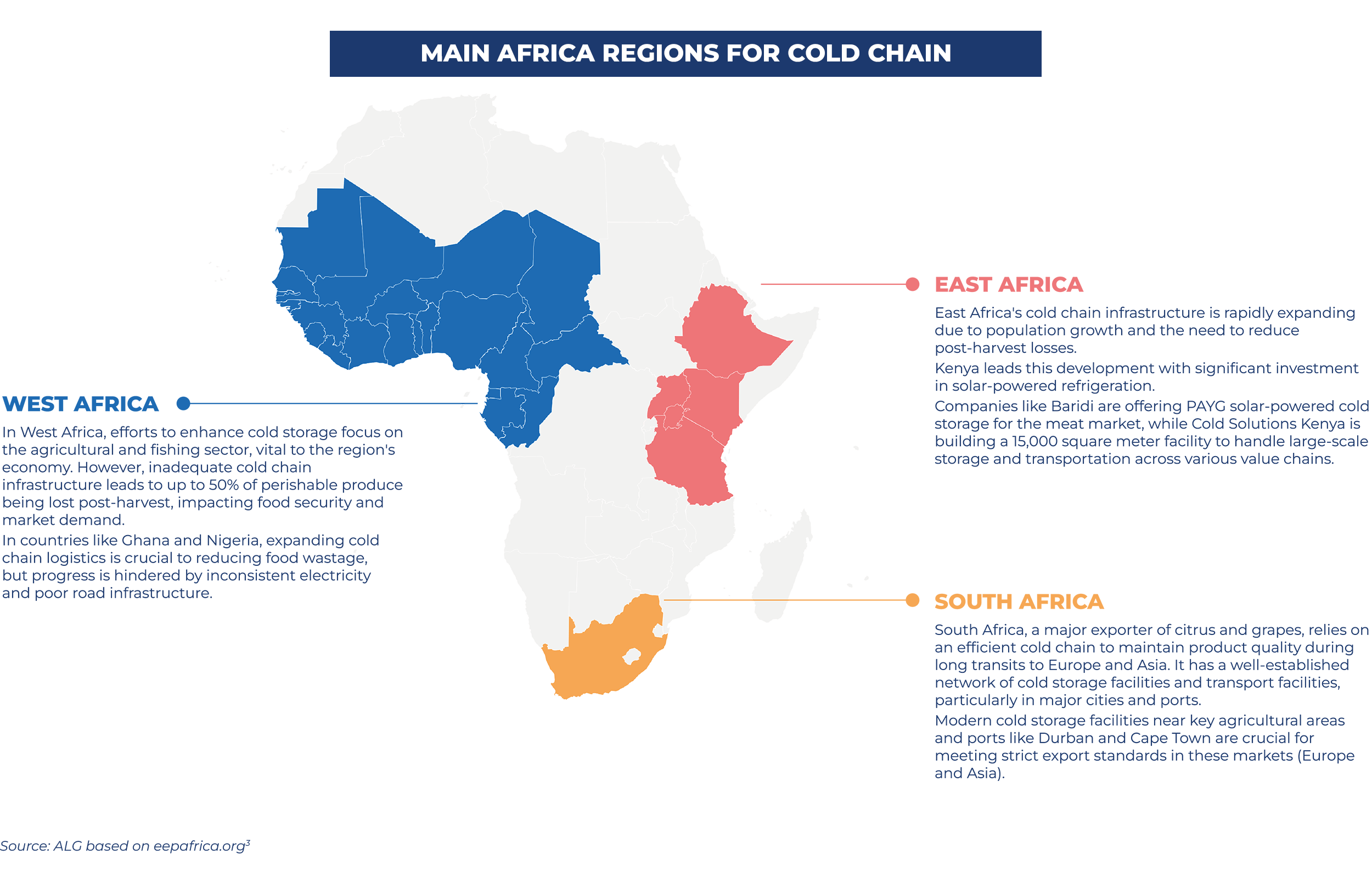

Cold chain logistics in Africa has lagged due to infrastructure deficits and high costs. Recent efforts aim to improve cold storage to reduce post-harvest losses, ensure food security, and support the pharmaceutical industry. However, cold chain infrastructure remains underdeveloped, with countries like South Africa having more advanced systems, while many in Sub-Saharan Africa face significant inefficiencies due to basic infrastructure challenges.

Other East Africa countries

- Uganda: significant potential for cold chain expansion due to its production of fresh produce and meat, supported by growing export activities and investments.

- Tanzania’s cold chain sector has an opportunity due to expected population growth. Agricultural sector is crucial for both domestic consumption and export, particularly to European and Middle Eastern markets. However, the lack of adequate cold storage facilities results in significant post-harvest losses (30-50%). These losses not only impact food security but also limit the income potential for farmers.

- Ethiopia's cold chain infrastructure is focus on export ventures, especially in the floriculture sector, which is a major contributor to the economy. There is growing government interest in expanding cold chain solutions to other sectors like produce, meat, and dairy.

- Rwanda's political stability, strong government support, and active private sector make cold chain solutions as an opportunity to implement. The country is also adopting eco-friendly cooling technologies as part of its National Cooling Strategy.

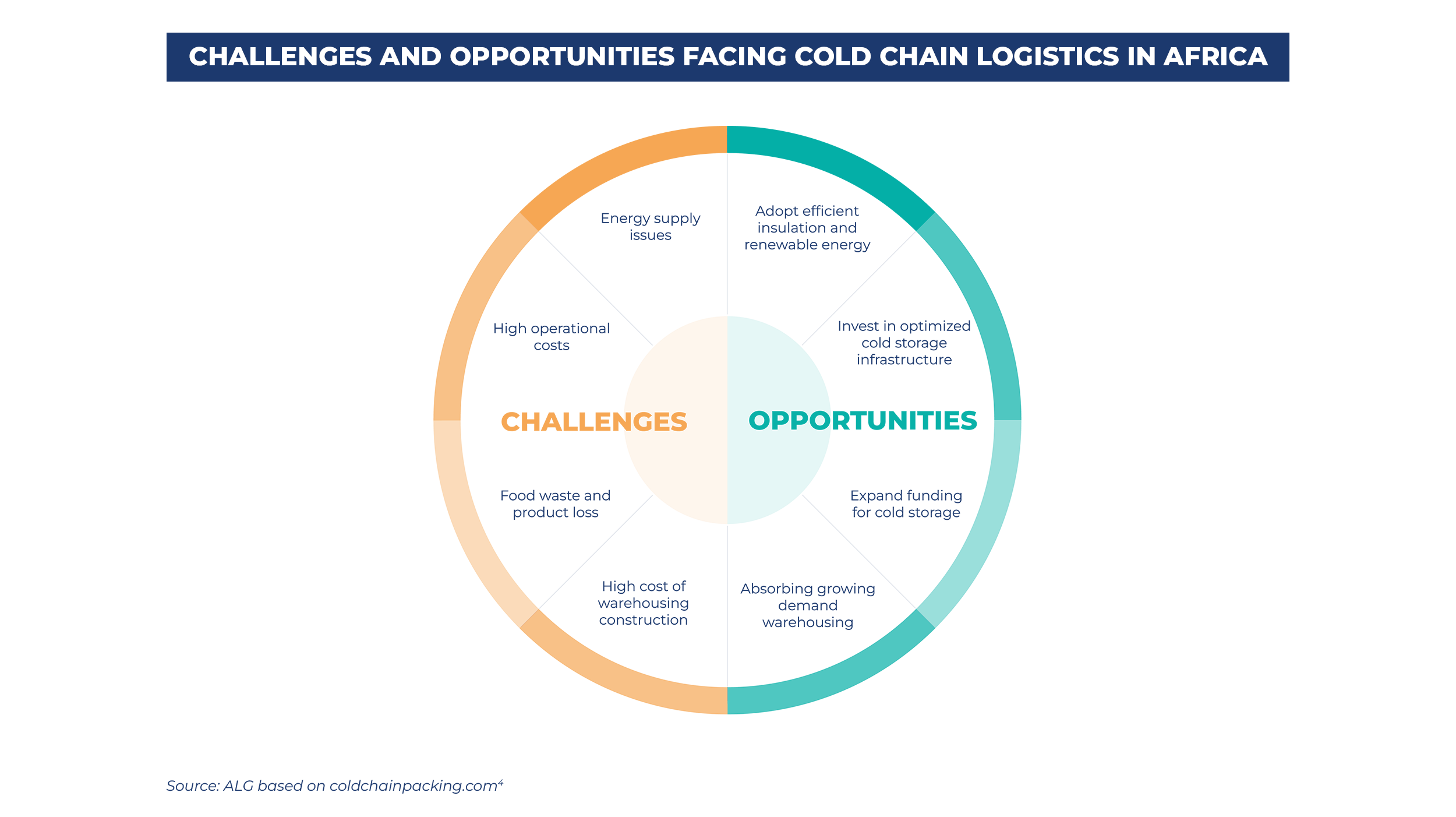

Challenges and opportunities facing cold chain logistics in Africa

The cold chain logistics sector in Africa is undergoing significant transformation. As the region addresses evolving demands and infrastructure needs, a range of opportunities and challenges are emerging.

Challenges

- Energy supply issues: Frequent power outages and inadequate construction materials lead to high energy consumption, making stable cold chain operations challenging in many African countries.

- High operational costs: Outdated stacking methods, inadequate racking systems, and costly building materials drive up expenses. Import duties, bureaucratic delays, and reliance on foreign technology add to the costs, making modern cold storage facilities expensive and complex to develop.

- Food waste and product loss: Africa wastes up to 50% of its food due to inefficient supply chains, with losses of 25-30% for animal products and 40-50% for perishables. This waste impacts food availability, resource use, and the environment.

- High cost of warehousing construction: Just in West Africa, warehouse construction costs are 66% higher than the continental average due to outdated buildings needing major renovations. This makes warehousing a less attractive investment in the region.

Potential solutions and the way forward

- Adopt efficient insulation and renewable energy: Improve cold chain energy efficiency by using better insulation and renewable energy solutions. Upgrading insulation cuts energy use, solar panels with net metering store excess energy, and central ammonia systems reduce electricity consumption by up to 40%.

- Invest in efficient cold storage: Small, self-sufficient cold storage units near production points can cut costs and improve efficiency. Modern racking and pre-cooling technologies enhance quality and exports. In East Africa, solar refrigeration units made up 42% of sales in 2022, indicating strong demand for such solutions.

- Expand cold storage funding: Increased funding from organizations like the World Bank aims to reduce food waste and loss by investing in modern cold storage. This support enhances infrastructure, preserves produce, and strengthens Africa’s agricultural sector, while promoting economic growth and reducing waste.

- Meeting growing warehousing demand: Despite high costs, the strong demand for modern warehousing in Africa, especially in Nigeria, Kenya, and South Africa, offers a profitable investment opportunity. With occupancy rates around 80%, investing in advanced facilities can yield significant returns.

Conclusion

The cold chain logistics sector is important to Africa's economic growth, especially in agriculture, fishing, and pharmaceuticals. However, it faces major challenges due to infrastructure deficiencies, resulting in food waste and limited capacity to meet demand. Factors such as unreliable energy, high costs, and insufficient storage are some of the most relevant challenges.

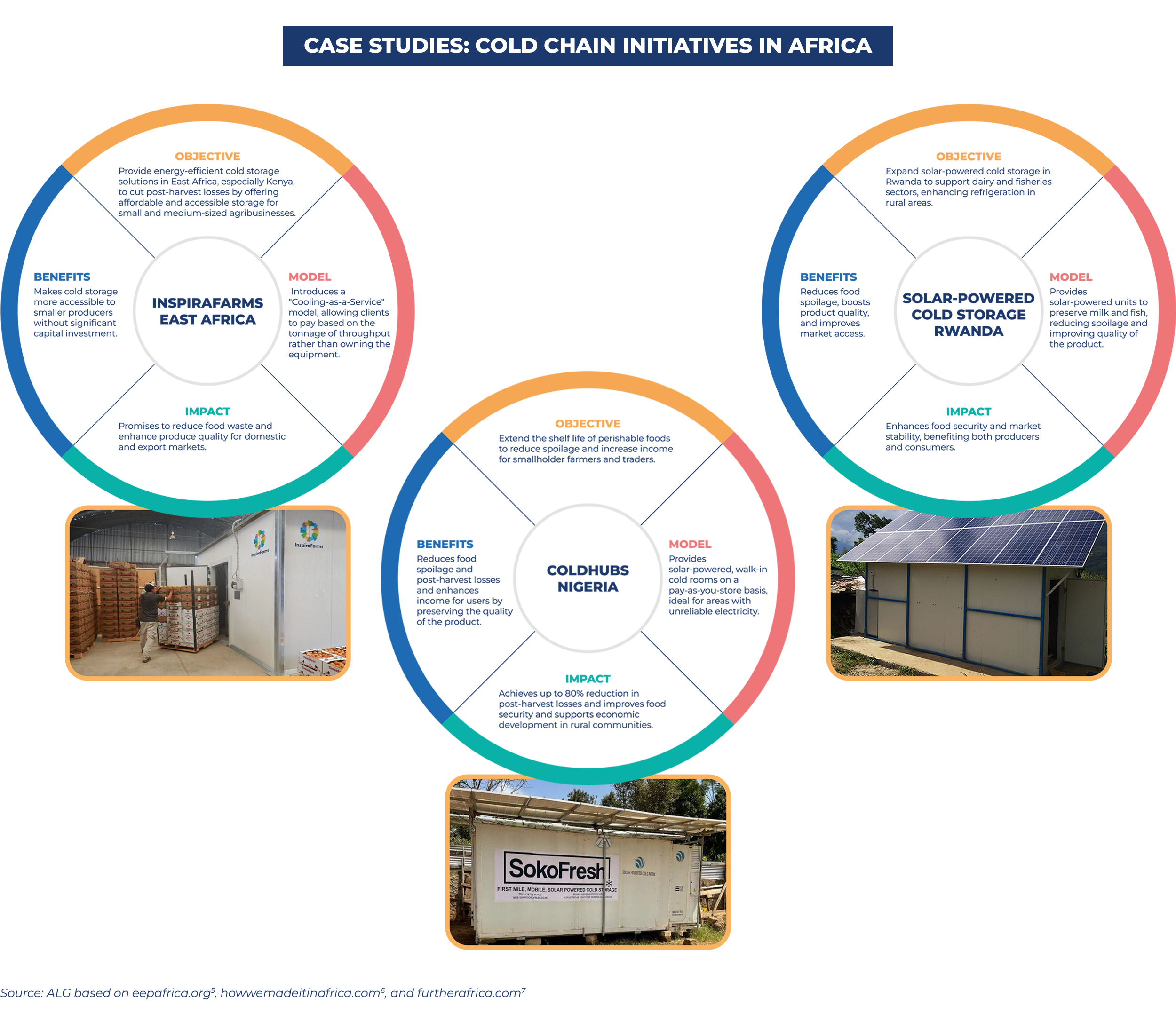

Despite this, investments in modern facilities, renewable energy, and strategic initiatives in countries such as Kenya, South Africa, and Rwanda are promising. Continued investment, innovation, and public-private collaboration are essential to improve energy supply, reduce costs, and expand capacity, which will improve food security, economic growth, and pharmaceutical distribution across the continent.

Sources

1- Cold Chain Logistics Market - Industry dynamics, market size, and opportunity forecast to 2032

2- Developing the cold chain in the agrifood sector in sub-Saharan Africa

3- Cold chain storage market assessment 2023

4- Challenges in Cold Chain Logistics

5- Southern Africa supply & demand

6- Cold storage for African farmers: Entrepreneurs see big potential

7- Delivering energy-efficient cold storage solutions across Africa