Since the launch of the first transport network concession initiative more than three decades ago, Brazil has been working to improve its road infrastructure operation alternatives. Within a context of public resources scarcity for highway maintenance and recuperation, the Concession Program was created in 1988, with the subsequent Working Group creation for the implementation of the Federal Highway Concession Program (PROCROFE) in 1993.

Since then, given the continuous demand for new funding sources, concession models underwent updates that sought to correct initial errors, such as better risk identification, as well as more precise definitions for risk allocation. The first difficulties led to the conception of mechanisms that today seem commonplace, but which were non-existent when the first concession projects were designed. Thus, the Concession Law (1995) was published, covering only the federal sphere, with later extension to concessions at state and municipal levels, approved by the Ministry of Transportation (1996); the Brazilian Association of Highway Concessionaires (ABCR, 1996) was founded, alongside with a regulatory agency, whose purpose would be to ensure compliance with the concession contracts, known as the National Agency of Land Transportation (ANTT, 2001).

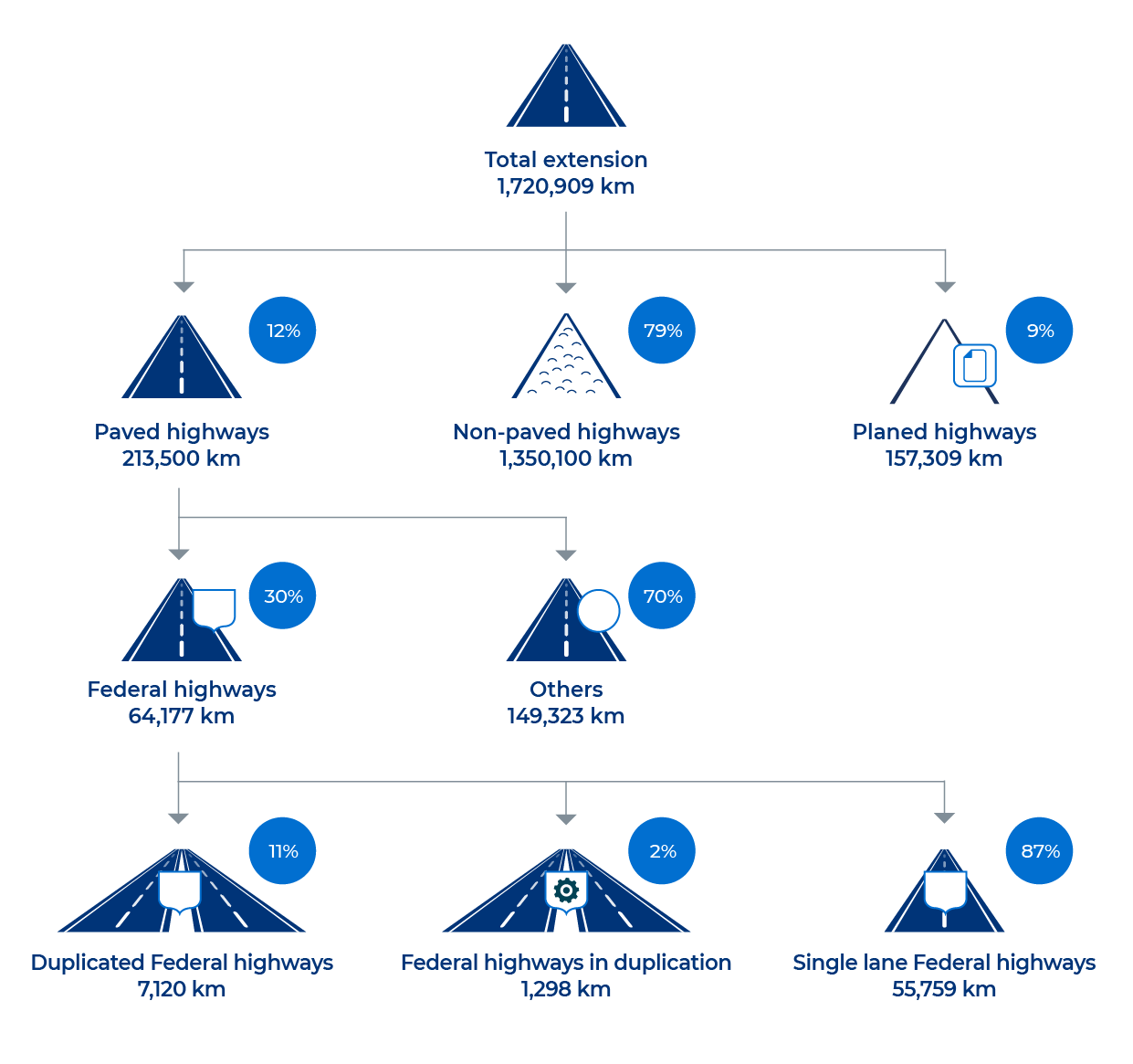

In terms of existing infrastructure, Brazil has more than 1.7 million kilometers of roads, of which only 213,500 km are paved (about 12% of the entire network). The distribution of the infrastructure is way heterogeneous, with a greater concentration of paved roads, both federal and state, in the southern and southeastern states.

Figure 1: Brazilian road network extension. Produced by the National Confederation of Transport (CNT) with data from the National Department of Transport Infrastructure (DNIT, 2021) and the Ministry of Infrastructure (2020)

Figure 1: Brazilian road network extension. Produced by the National Confederation of Transport (CNT) with data from the National Department of Transport Infrastructure (DNIT, 2021) and the Ministry of Infrastructure (2020)

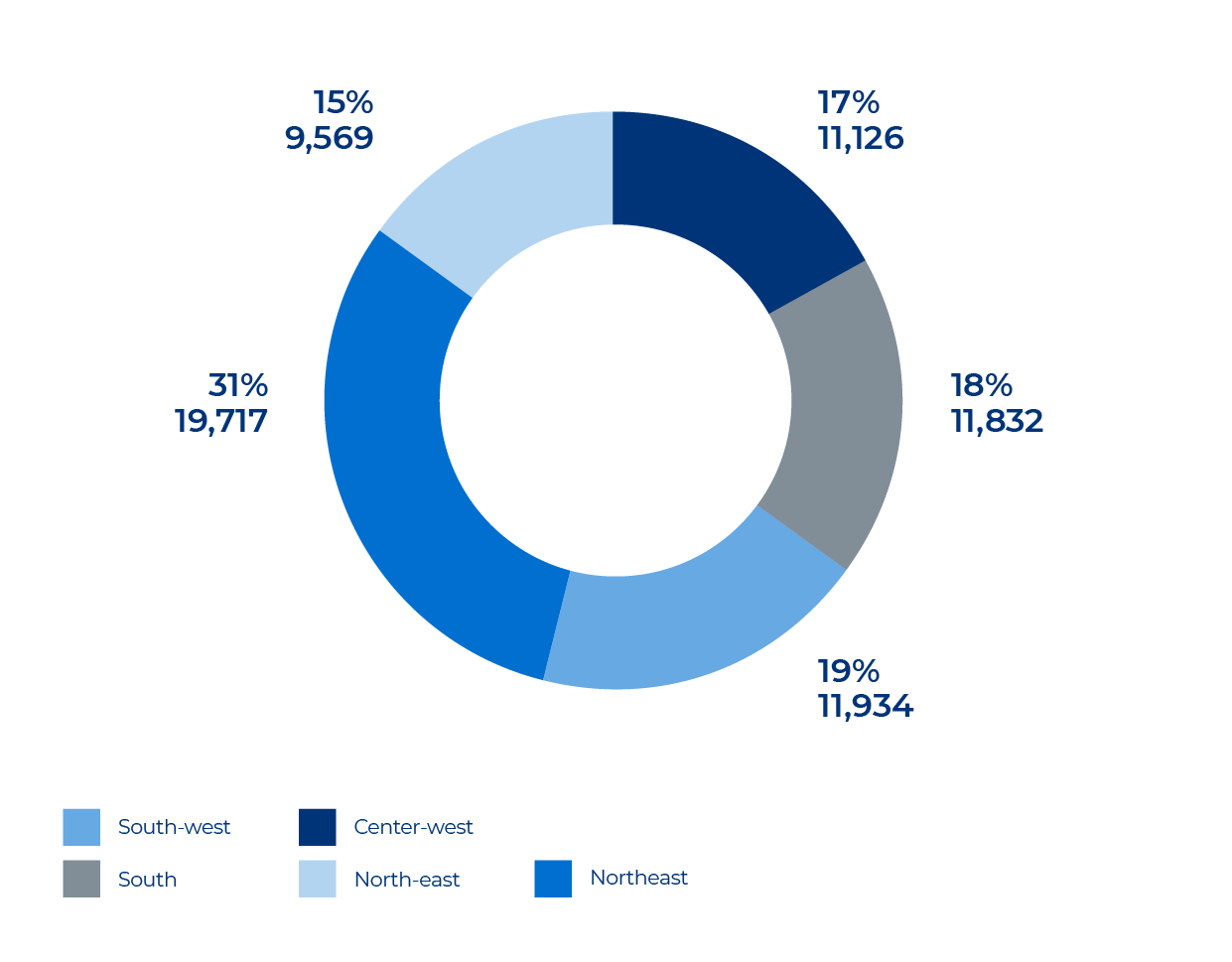

Figure 2: percentage of the extension of paved federal highways by region in Brazil (values in km/thousand km²). Produced by CNT with data from DNIT (2021)

Figure 2: percentage of the extension of paved federal highways by region in Brazil (values in km/thousand km²). Produced by CNT with data from DNIT (2021)

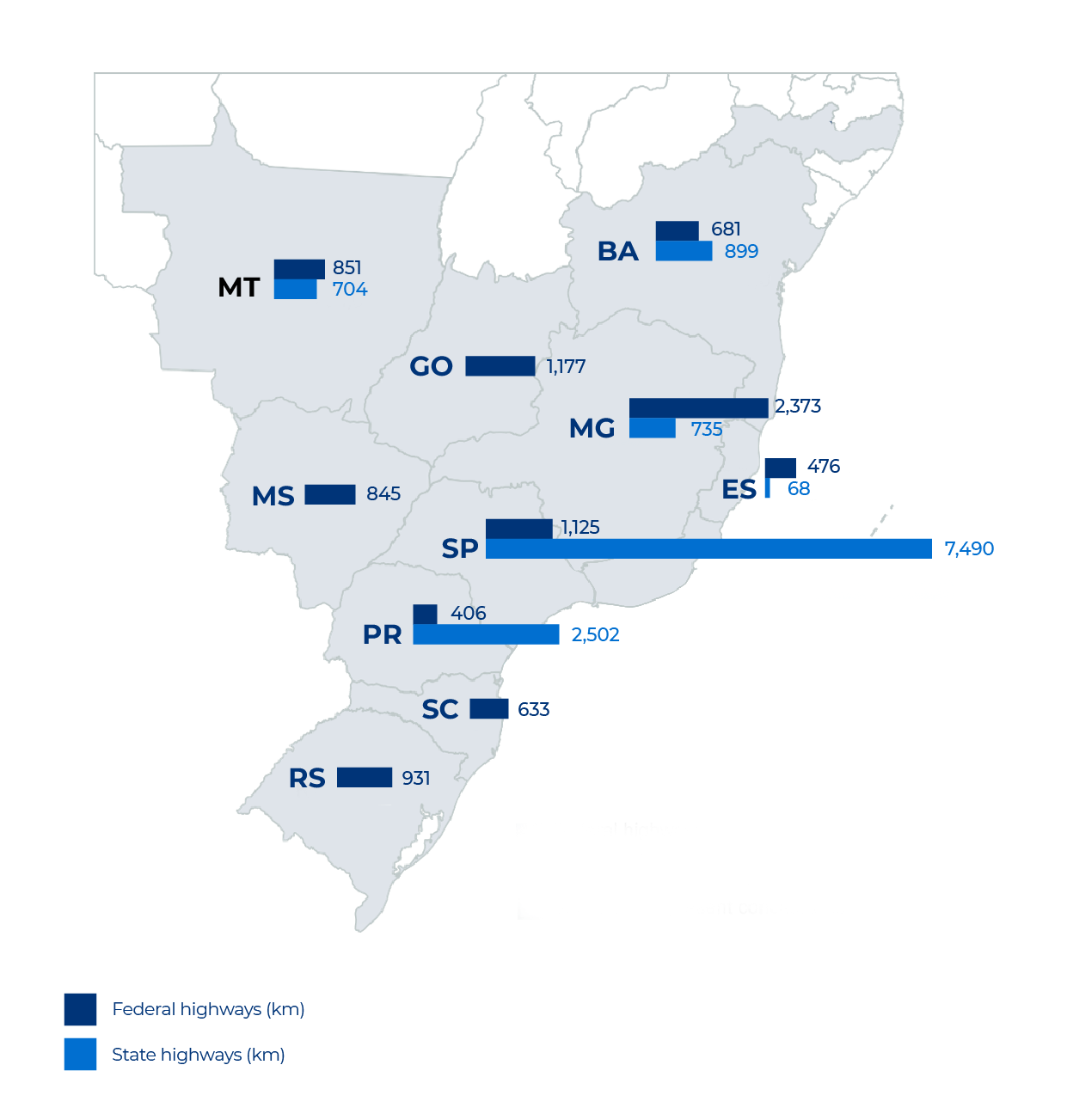

According to ABCR, in 2020, 68 concessions were in operation in Brazil, practically state and federal, totaling 23,320 km bidded. São Paulo led the state network under concession (7,490 km), while Minas Gerais had the largest federal network under concession (2,373 km). According to more current data presented by the National Transport Confederation (CNT, 2021), Brazil has 189,864 km of paved roads under public management and only 12% (23,636 km) under concession regimes.

Figure 3: location and extension of existing concessions in 2020. Produced by ABCR, 2020

Figure 3: location and extension of existing concessions in 2020. Produced by ABCR, 2020

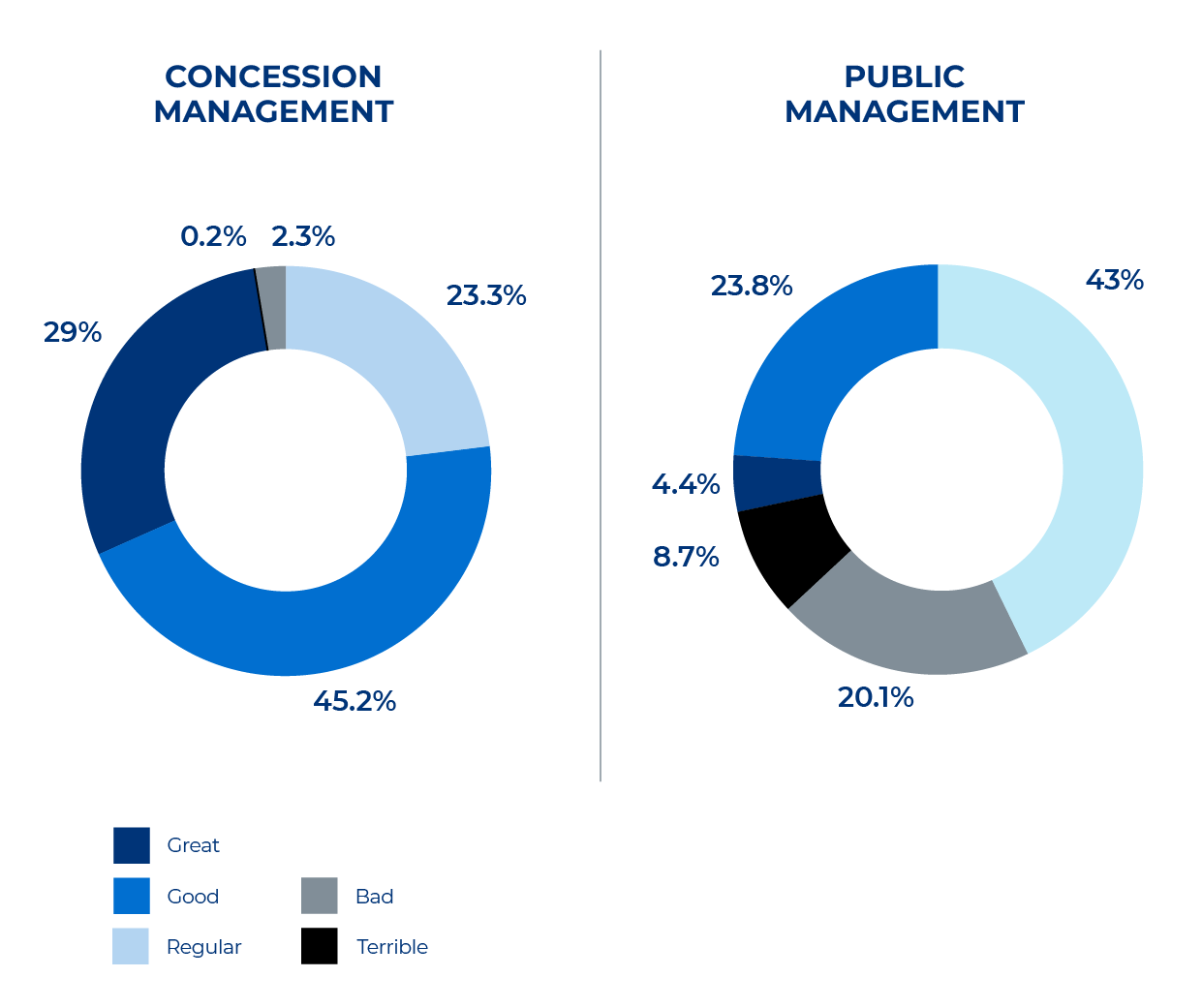

If on the one hand new alternatives for concession models are offered, on the other there are constant reductions in investments for highways managed by DNIT, which leads to accelerated infrastructure deterioration and, consequently, worse service levels. In general, the research conducted by CNT shows that "the granted stretches have presented, continuously, better results in the evaluation of the CNT Highway Research, which proves the effectiveness of investing in maintenance and adequacy of road capacity”.

Figure 4: general state classification of roads under concession and Public management. Produced by CNT, 2021

Figure 4: general state classification of roads under concession and Public management. Produced by CNT, 2021

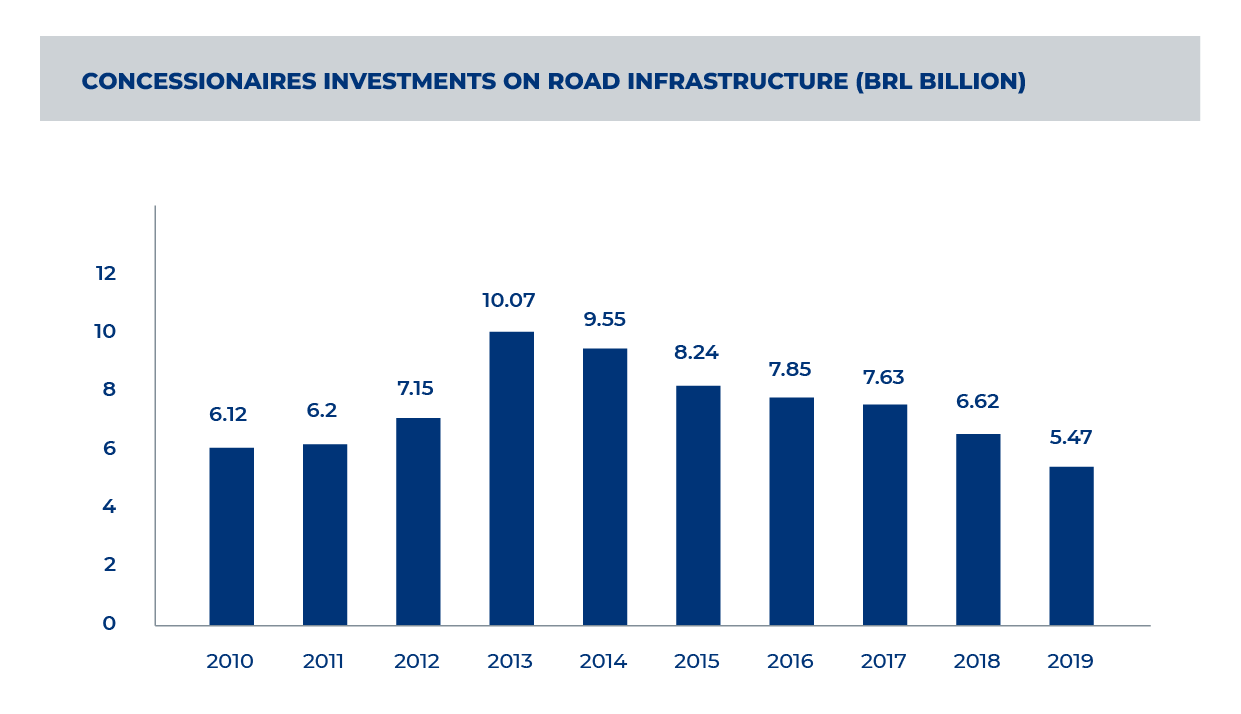

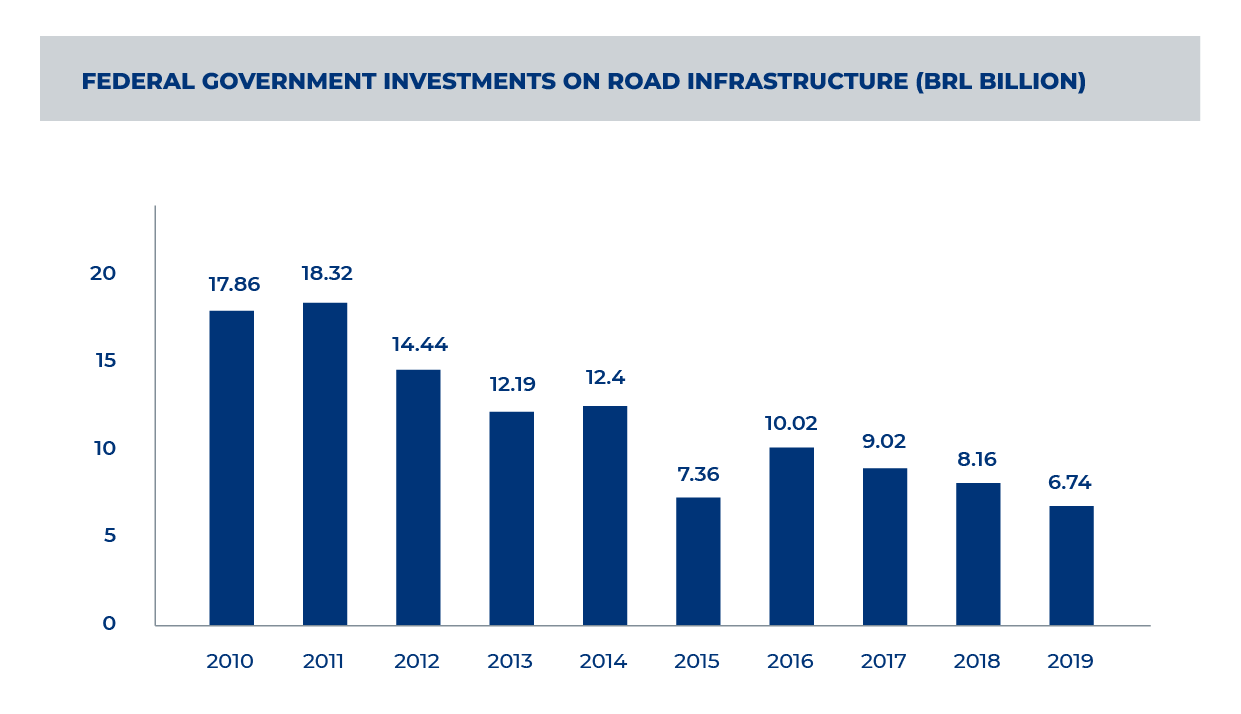

Even if concessionaires have been delivering a growing quality pattern of road infrastructure, investments, both private and public, are still not sufficient and have faced a downward trend since 2016. Aiming to address this picture of "disinvestment", ABCR's strategy today is to encourage projects structured by the Federal Government and State Governments to double the network currently under concession in the coming years. According to its president, Marco Aurélio de Barcelos Silva, within 5 years, the 24,000 km of concessioned roads may become 48,000 km, of which about 19,000 km would be structured by the Federal Government.

Figure 5: concessionaires and Federal Government investments on road infrastructure (base date: December/2020). Produced by CNT, 2020

Figure 5: concessionaires and Federal Government investments on road infrastructure (base date: December/2020). Produced by CNT, 2020

Under the Investment Partnerships Program (PPI), several federal highway projects undergo qualifications that can justify a future bidding process. From a logistics perspective, 7,213 km of federal highways considered strategic were qualified in 2019, distributed in 13 states. Additionally, some projects are already in public consultation phase (BR-040/GO/MG; BR-262/MG e BR-153/262/GO/MG; center-west and north lots (CN1/CN2) and Rio Grande do Sul lots).

Even with the constant updating of contract models and business plans, it is not possible to affirm that Brazil has built a master model that fits all existing geographical and economic contexts. The great diversity within the country requires a variation of contract models to embrace projects of smaller extension and lower traffic volume. Some alternatives have already been practiced, such as bidding processes based on the lowest toll rate; highest grant with a pre-fixed toll; lowest toll and highest grant; pre-fixed toll and longest extension, among others. In general, especially after the Concessions Law update, the most recent contracts have been proposed to offer more attractive mechanisms to private players who are interested in operating all kinds of infrastructure in Brazil.

Despite the great efforts applied in structuring projects, concession models are not always ideal to match the needs of each project. According to the National Confederation of Industry (CNI), among the main difficulties in designing successful concessions are unrealistic investment plans; full allocation of demand risks to the concessionaire; aggressive bidding and tariff modicity supported by subsidized financing, which have been mitigated with the updating of contract models. Within ALG's field of activity in Brazil, the studies carried out aim precisely to avoid the adoption of unjustifiable strategies, as well as to point out appropriate solution alternatives for the reality of the evaluated infrastructure, always seeking to achieve a framework appropriate to the restrictions and difficulties presented by the project.