Overview of the current state of freight transport by rail

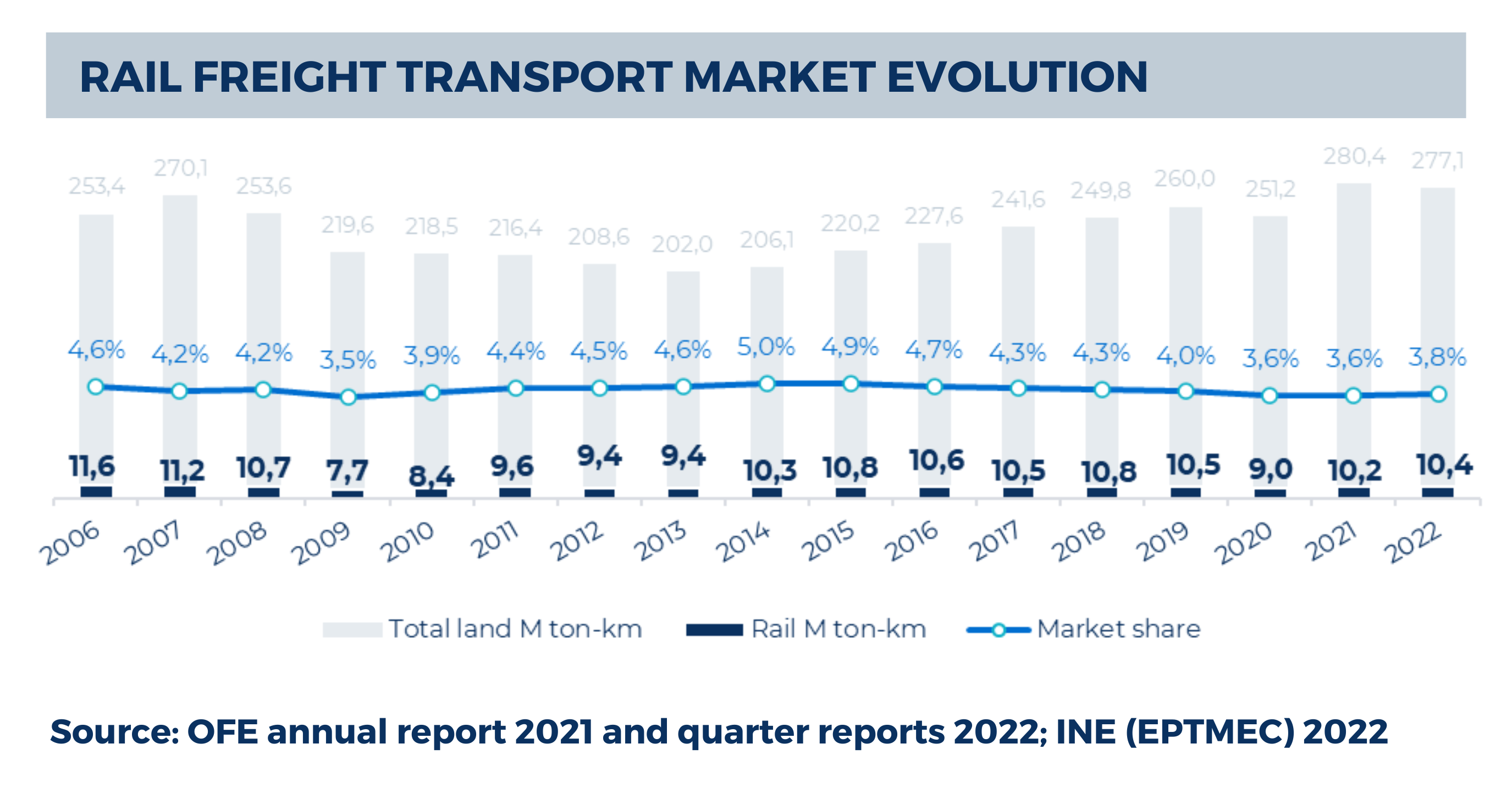

Rail freight transport in Spain stagnated during the last two decades, despite market liberalization in the mid-2000s. In 2022, transport raised to 10.4 million ton-kilometers, 7% below 2007 levels, the first year of effective liberalization.

Also, the modal share of rail within land transport has remained low, at around 4% (in ton-km). This inability to capture a larger share of the market can be attributed to several factors, such as:

- Very limited flexibility of the supply of rail services (lack of capillarity) which hinder their adaptation to current logistics chain requirements

- Low impact of the cost of infrastructure given the high percentage of free high-capacity roads and subsidized tolls

- The absence of subsidies to rail operators

- Historical conventional rail infrastructure gaps, except at some priority corridors, which hinder freight rail performance: sidings, connections, etc.

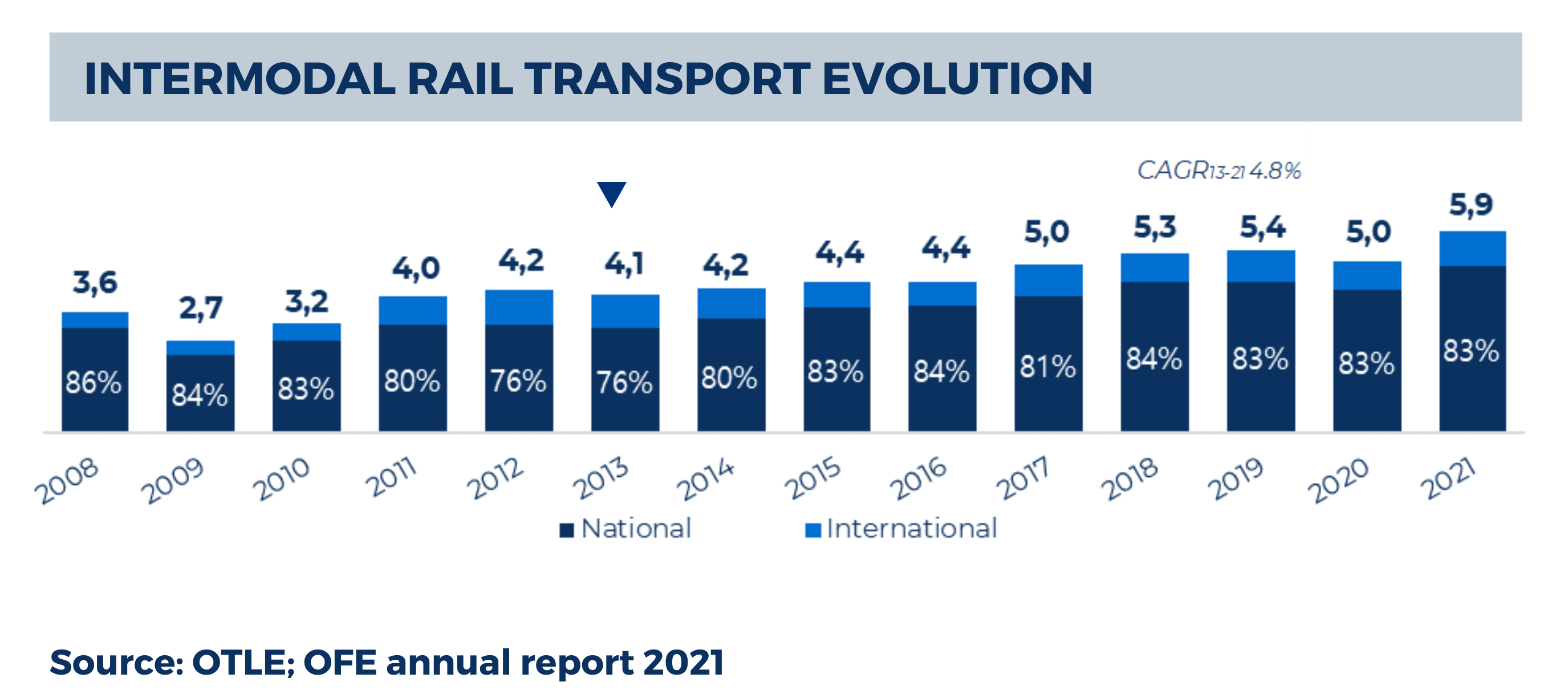

However, it is important to highlight that in recent years intermodal rail transport (containerized freight) traffic has experienced a remarkable increase. The intermodal sector has grown at an annual average rate of 4.8% since 2013, driven by the increasing activity and market share of private operators. Intermodal traffic constitutes more than 50% of freight rail traffic in Spain, accounting for 58.4% in 2021, and it is expected to continue its upward trend.

In Spain, the primary generators of intermodal rail traffic are ports, inland consumption centers, and international borders with France. The close relationship between rail freight and seaports has been strengthened over the years, as the transportation of goods by sea and rail complement each other and infrastructure developments have focused on this segment. In fact, currently 80% of Spanish container land transport occurs on routes connecting to ports.

Certain ports in Spain, such as Bilbao and Barcelona serve as outstanding examples of the potential for intermodal rail traffic, with modal share of 27% and 15%, respectively.

Competitive landscape

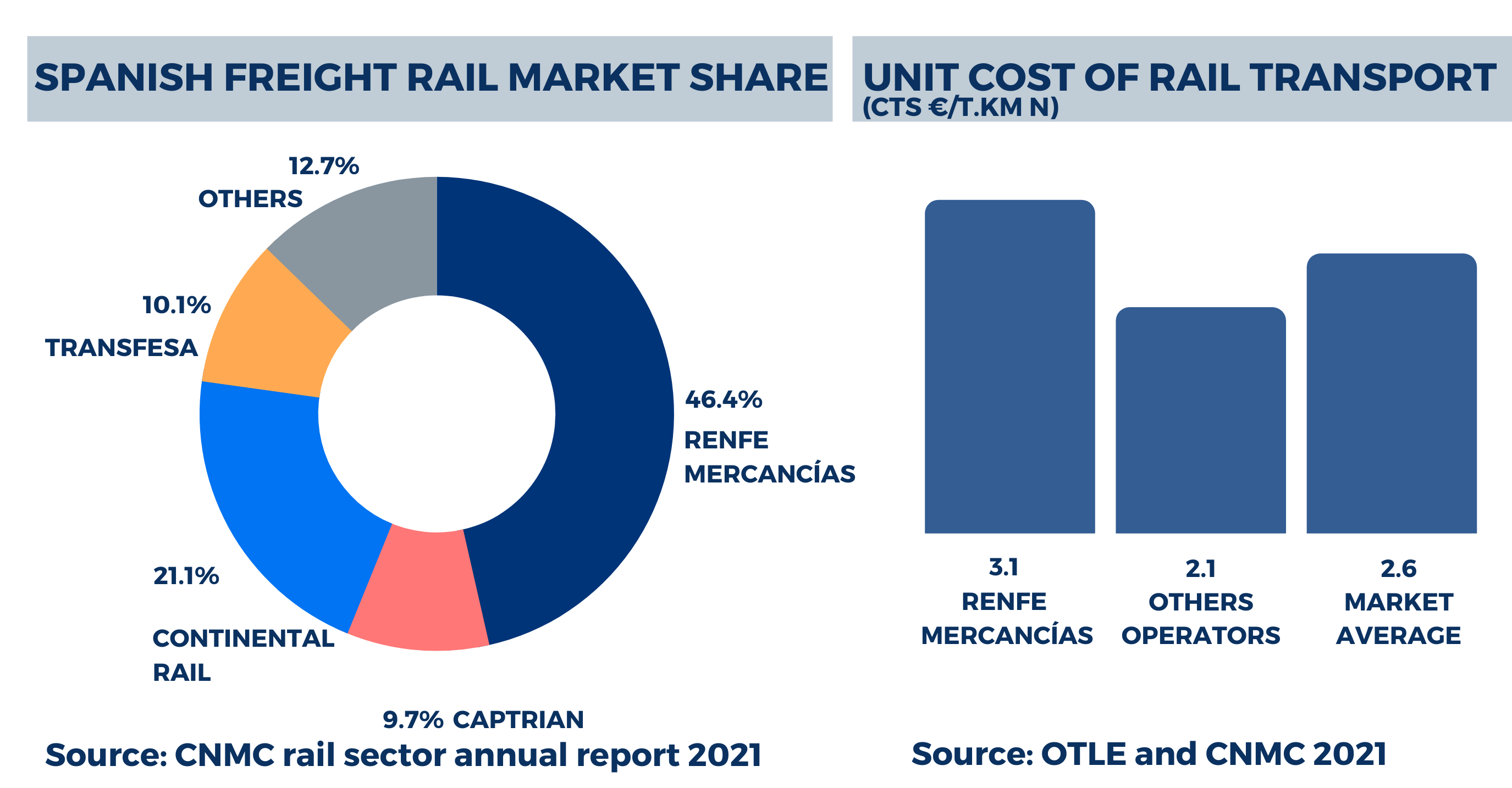

Following its liberalization, the market has become increasingly competitive, with 10 companies disputing market share, but most of them are very small. The Spanish freight rail market features a large public operator, Renfe Mercancías, and numerous smaller companies. Since the market opening, the dominant operator, Renfe Mercancías, has experienced a steady decline in its intermodal market share, dropping below 50% in recent years (46% in 2021).

The competitiveness of a certain transportation mode is highly dependent on its cost-effectiveness, and the liberalization of the rail freight market aimed to address this concern. However, the unit cost of the Spanish leading operator is still 47% higher than that of its competitors.

Government initiatives and plans to boost rail transport

The Spanish government has taken steps to boost rail freight despite slow growth in the sector. Implementing initiatives such as: (i) Mercancías 30 strategy, (ii) some initiatives within Recovery, Transformation, and Resilience Plan, and (iii) search for a potential private partner for the public railway operator.

Mercancías 30 initiative is part of the 2030 mobility strategy that outlines measures to promote rail freight transport as the backbone of multimodal logistics chains. The initiative aims to double the modal share of rail freight transport in Spain by 2030 through six action blocks: Infrastructure, capacity management, terminals, rail motorways, digitalization, and support with economic and financial resources.

As part of the Recovery, Transformation, and Resilience Plan, the government has recently introduced subsidies aimed at promoting rail freight transport. The subsidies, totaling €335 million, are used, for example, for the acquisition of rolling stock.

Additionally, to enhance competitiveness, Renfe is in the process of bringing MSC shipping line as private partner to operate Renfe Mercancías. This move is part of the government's efforts to promote rail transportation and increase competitiveness in the industry.

Opportunities for growth

Even if it has not observed any significant market share growth over last years, the Spanish freight railway presents opportunities for future increase such as the Mediterranean and Atlantic infrastructure developments. The Mediterranean Corridor will connect Spain with the European rail network increasing international (long distance) freight traffic flows from the main Spanish ports. The Atlantic Corridor, on the other hand, will help connect Spain with Portugal, France, and the rest of Europe, improving also rail freight transversal traffic flows.

Another key investment is taking place at Valencia Port, where the port authority (APV) plans to invest approximately €240 million in improving accessibility and the rail network to increase intermodal transportation. Their goal is to gradually increase the rail modal split until it reaches 18%, the average in the European Union.

The development of the Trans-European Transport Network, combined with the rail enhancements at Valencia Port, holds significant potential for the railway market.

Finally, the Government is working on a potential agreement through which a private industrial partner would participate in Renfe Mercancías operations. Shipping lines are the best suited partners in that regard given the importance of intermodal transport flows generated by the ports. These investments could make the company more efficient and flexible, thereby raising the overall competitive of rail transport.

Conclusion

The intermodal freight sector, fueled by private operators, has emerged as the primary driver of future growth for rail traffic in Spain. The government initiatives, such as investment plans and the entry of a private partner in the public operator, combined with the development of railway infrastructure to improve connectivity with Europe will help sustain the growth of rail traffic volumes.