In today’s experience-driven economy, nautical tourism continues to grow, and marinas are quietly becoming hubs of economic development, innovation, and sustainability.

Marinas have evolved from simple boat docks into critical infrastructure, driving coastal economies and regional development. As a result, they are attracting increasing interest from strategic investors.

Why invest in marinas?

As nautical tourism accelerates, marinas are becoming a strategic asset and represent a unique investment opportunity. But why is that?

- Because the market has strong long-term growth potential

- Because marinas generate recurring and resilient revenues

- Because supply is limited, and entry barriers are high

1. Long-term growth potential

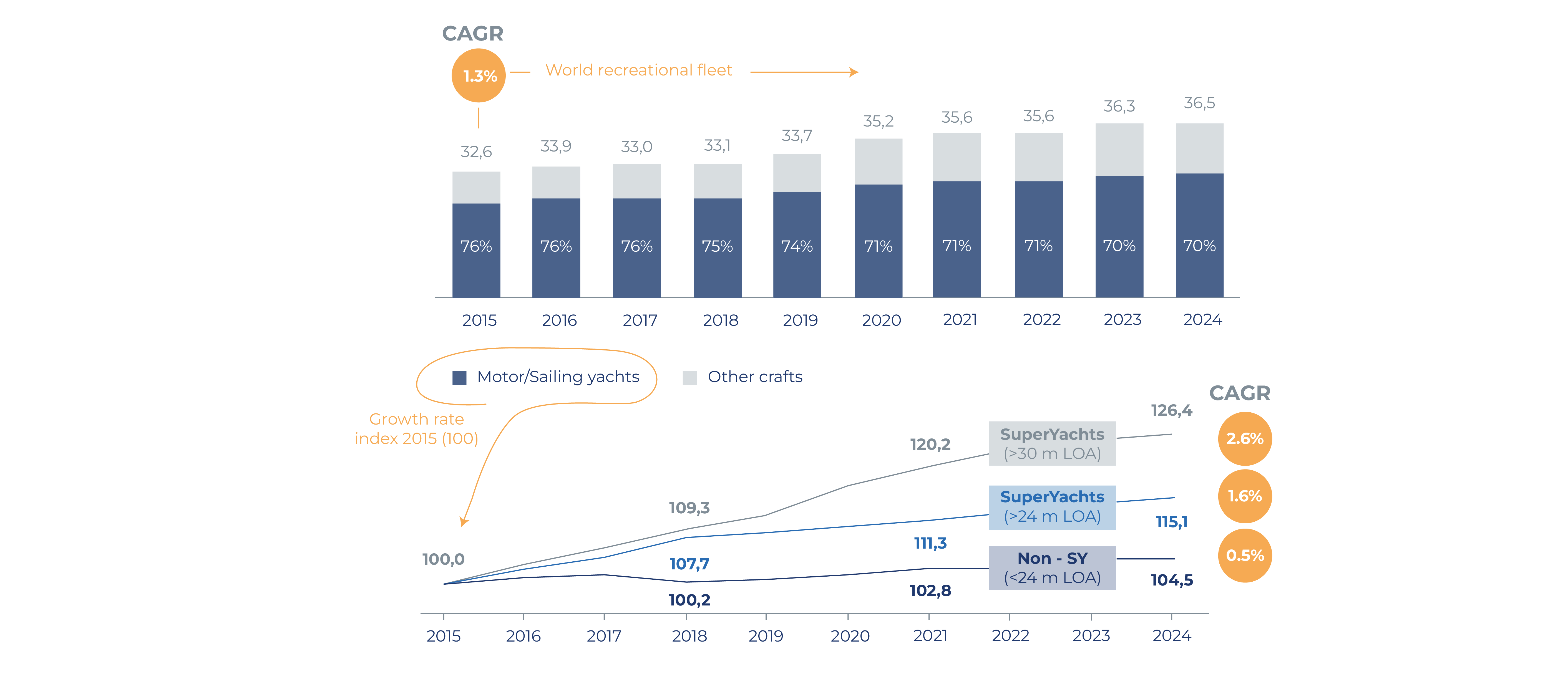

One of the biggest draws of marinas is their long-term growth outlook. The global nautical tourism market is expanding steadily, and the number of recreational boats continues to climb. Today, there are over 25 million motor and sailing yachts worldwide, and that number is rising quickly, especially among larger vessels that require more advanced infrastructure.

This rise, along with increasing ownership of recreational vessels, is boosting the need for additional berths.

Looking ahead, as nautical tourism continues to expand, the global marina market is expected to double in value over the next decade, driven by demand, scarcity of suitable coastal land, and technological transformation.

2. Recurring and resilient revenues

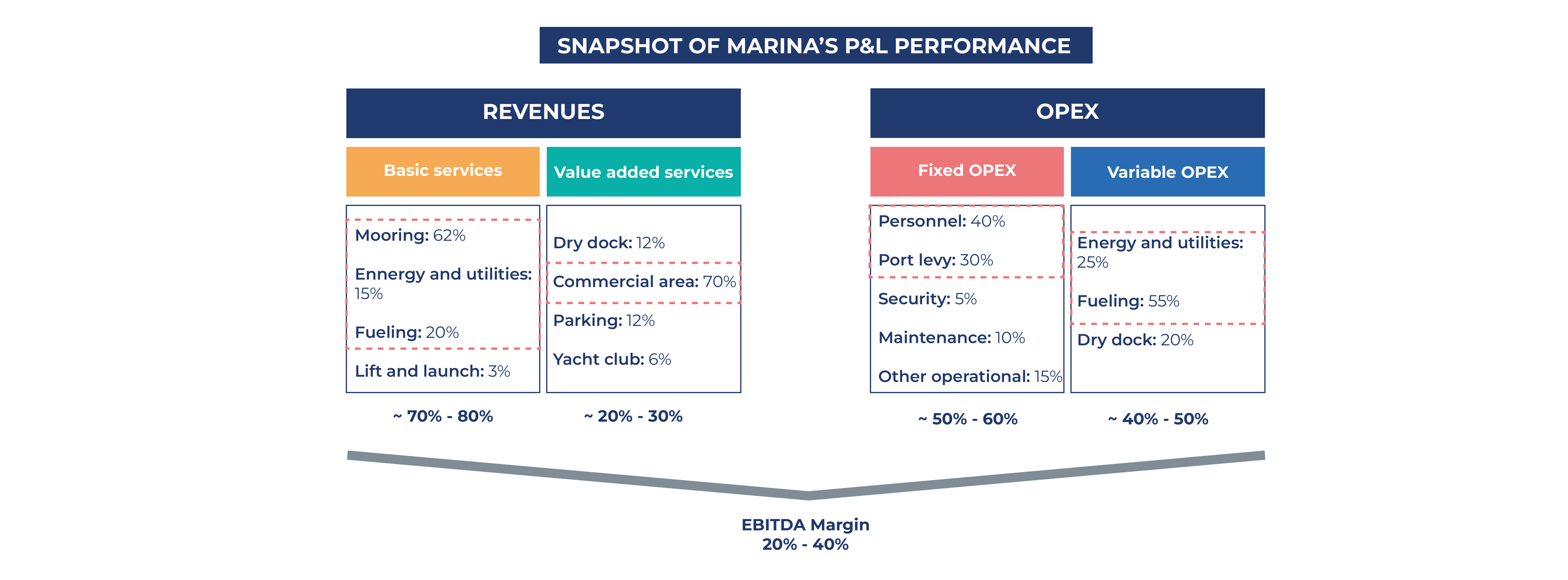

Marinas have strong fundamentals, earning solid returns. These infrastructures generate consistent cash flow through berth rentals, maintenance services, fuel supply, and retail activities.

Demand tends to be stable year-over-year, largely as operators often see strong customer retention, creating stable, predictable cash flows. Some even compare marinas to commercial real estate.

From an operational standpoint, berth occupancy rates are a key metric that drives topline and render marinas with EBITDA margins ranging between 20–40%, depending on location, size, service model, and competitive positioning.

3. Limited supply and entry barriers

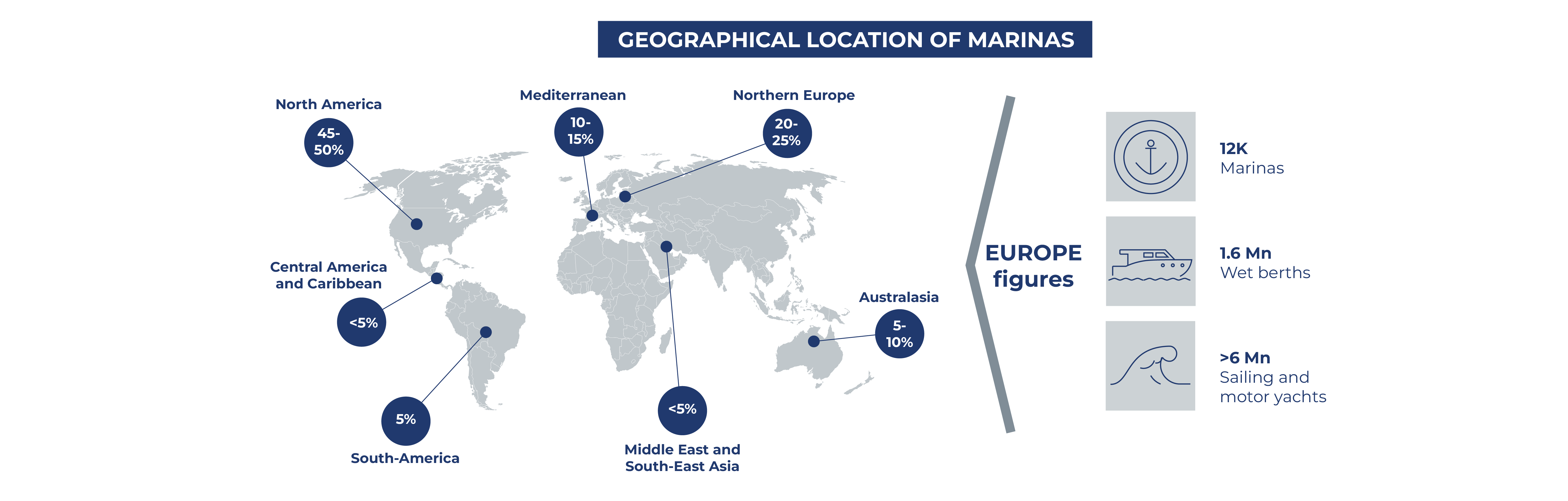

The growing demand for berths is outpacing supply in most regions, putting pressure on existing infrastructure. In Europe, more than 80% of marinas operate near full capacity during high season. In hotspots like the Balearic Islands or the Côte d’Azur, waiting times for a berth can exceed two years. In this environment, marinas with the right location and services hold enormous value.

Additionally, part of what makes marinas such compelling investments is how hard it is, in most regions, to build new ones. Coastal land is scarce and heavily regulated (environmental restrictions, zoning laws, permits, etc.), creating significant barriers to entry.

This scarcity, both in berths and land availability, is a key competitive advantage that protects the value of existing assets, limits future competition, and makes them even more appealing to investors.

What are the challenges?

Despite the brightness of the future, the marina sector faces three major challenges that are reshaping the sector:

- Demand pressure: infrastructure needs to keep pace with the evolution of the fleet. Modern vessels are larger and more sophisticated, requiring deeper berths, high-capacity energy systems, and advanced services.

- Sustainability and digitalization: Regulatory pressure and market expectations are driving a shift toward greener and smarter marinas: from electrification of berths and renewable energy to digital booking platforms and smart maintenance systems. Marinas, due to their manageable scale compared to larger commercial ports, are called to lead the way in the blue transition.

- Evolving user preferences: Ownership models are changing. Boating as-a-service rises with subscription-based boating, shared ownership, and pay-per-use access gaining popularity. Today’s marina users expect more than just mooring—they’re looking for connectivity, comfort, lifestyle services, and vibrant waterfront experiences, while living with traditional marina users.

Forward-looking marina operators are responding to new market trends, while marinas that can’t adapt will lose ground to those that can.

Where is the opportunity?

Globally, the marina sector remains highly fragmented. Many marinas are owned and operated by small players, leaving the door open for consolidation, transformation, and investment-driven upgrades.

We’re already seeing movement from major players. MarineMax expanded globally with its acquisition of IGY Marinas in 2022. Safe Harbor Marinas, acquired by Blackstone in 2025, is positioning itself for long-term, inflation-protected returns. Meanwhile, regional leaders like D-Marin, with a footprint in Europe and the Middle East, are actively expanding their portfolios and repositioning assets to capture long-term value.

Whether through acquisition, transformation, or greenfield development, there is space for new entrants and strategic partners to shape the future of this market, with many regions still offering untapped potential.

Should you take a position?

The best opportunities are those that align with your strategy — asking “Does this fit my strategy?” helps you recognize them more effectively.

Marinas stand out as a compelling option, offering a rare mix of long-term value, tangible assets, and alignment with global sustainability goals.

They provide an attractive diversification opportunity for investors seeking alternatives to traditional real estate or infrastructure assets.

They’re resilient infrastructure with strong territorial anchors, backed by recurring revenues and growing demand. As part of the broader economy, they’re catalysts for coastal regeneration, job creation, innovation, and climate-conscious development.

If you’re focused on long-term growth, asset diversification, and investing in future-proof infrastructure, now might be the right time to take a closer look at the marina sector.

Because the tide is rising—and those who move early may be best positioned to navigate it.